Core Vaults: The Infinite Strategy Engine

Infrastructure for the Next Trillion in Onchain Assets

Unifying DeFi’s Yield Landscape

Institutional capital is entering crypto under a new rulebook – ETFs approved in the US, MiCA in Europe, Basel exposure rules, stablecoin regulation on the horizon. Digital assets are finally investable. The floodgates are opening.

What institutions discover, though, is a fractured market. Yield sources have multiplied across chains, protocols, and instruments. Looping, restaking, tokenized funds, undercollateralized credit – each primitive adds a new risk surface and new operational steps. Strategy design becomes coordination – approvals, limits, hedges, exits, reporting.

The challenge is not sourcing yield – it is enforcing control. Without standardization, liquidity fragments, auditability disappears, and compliance breaks.

Institutions feel it the most. They need the basics to be in place: who controls what, how risk is reported, and how it passes audits. They need strategies that fit compliance and custody policies – not a messy sprawl of dashboards and manual workarounds.

The onchain stack must evolve. Strategy, execution, and risk management should live in one programmable surface – not across multiple brittle integrations.

Core Vaults by Mellow solve this by turning fragmented opportunity into an operating system for onchain yield – one framework that standardizes strategy design, unifies execution across DeFi and CEXes, and embeds risk tooling and controls from day one.

Enter Core Vaults

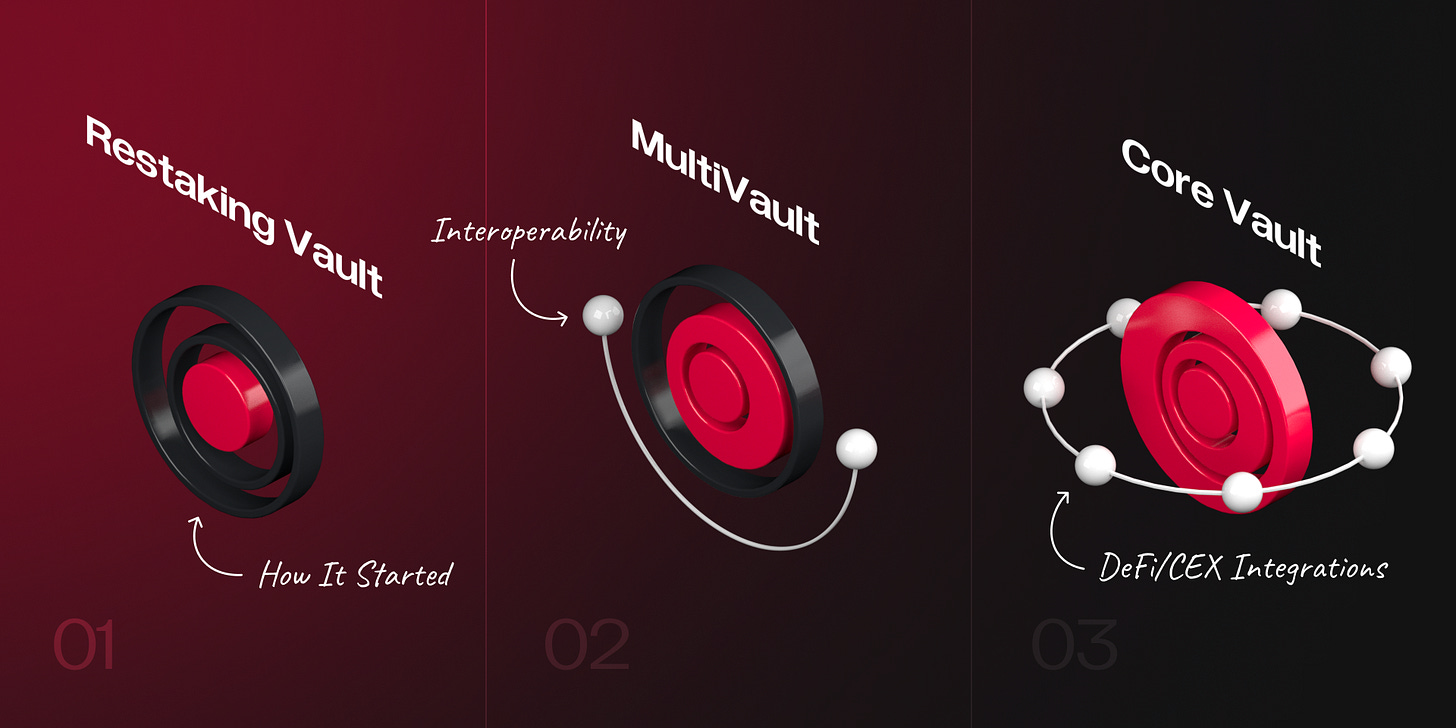

Mellow was one of the first protocols to develop vault infrastructure in DeFi. Since 2021, we have operated without a single security incident. We started with launching vaults for concentrated liquidity management – automating complex positioning while keeping funds fully trustless and composable. From there, we built MultiVaults – an architecture tailored to restaking, consolidating diverse operator sets and yield streams into a single vault. Then came Interop Vaults – a breakthrough that unlocked restaking on Ethereum mainnet to any EVM chain, eliminating the need for bridging.

This progression was not accidental – each generation of vaults solved a structural barrier to capital efficiency. Core Vaults are the culmination of this trajectory: a universal strategy engine designed for institutions and curators.

Why Core Vaults Matter

As institutional capital prepares to enter digital assets under clearer regulatory frameworks, demand is shifting toward structured products with the same precision, control, and transparency expected in traditional finance.

Core Vaults are designed to meet that demand:

Granular control – each vault is isolated with per-vault limits, asset whitelists, and dedicated verifiers that enforce strategy permissions. These controls can be set by the curator or by the client – such as an ecosystem or asset issuer – to reflect their own risk framework. In this model, the curator operates inside parameters defined by the client, ensuring strategies remain aligned with institutional mandates while depositors retain full control of funds.

Programmable flexibility across venues – run any strategy across DeFi and centralized exchanges using composable modules and automated hooks. Delta-neutral strategies, leveraged looping, cross-chain restaking – all in one framework.

No integration friction – protocols connect without custom adapters or added engineering. The vault design abstracts execution, reducing integration timelines to near-zero. Curators can plug in protocols without writing a single line of code.

CEX access through secure custodial rails – execute hedged or delta-neutral strategies on Tier-1 exchanges through institutional settlement networks. Core Vaults plugs with Copper ClearLoop and Binance Ceffu, enabling access to exchanges such as Binance, Bybit, Deribit, OKX, Coinbase, and others. Custody never passes to the exchanges – assets remain under secure settlement and operational controls preserved.

Secure redemptions in batches – withdrawals are grouped to lock fair pricing, reduce gas costs, and avoid UX pitfalls. For curators, this design ensures predictable operations, controlled redemption cycles, and resilience under stress events such as oracle disruptions – avoiding the need for emergency actions or constant monitoring.

Accurate, policy-aware execution – deposits and redemptions reference fresh oracle prices, removing stale data risk and enforced lockups.

Instant access for trusted actors – signature queues enable one-transaction deposits and withdrawals for pre-approved participants, enabling instant reaction to market opportunities.

Two-tier oracle safety – layered hard checks and suspicious-deviation filters block manipulated or suspect price feeds before they can affect a vault.

Risk management built in – beyond isolation, Core Vaults support curator-defined risk tiers, compliance modules for AML and KYC on curator side, and governance safeguards. Contracts undergo multiple independent audits; live monitoring and multisig controls protect critical operations. Neither Mellow nor curators ever take custody. Subvault isolation ensures that conservative, moderate, and high-risk strategies remain fully isolated.

Progress toward full autonomous decentralization – the roadmap paves the road to permissionless oracles, autonomous execution, and trust-minimized curator roles, extending the system’s neutrality as it scales.

Core Vaults embed risk management into the architecture itself – not as costly wrappers, but as native features. This allows institutions and curators to operate on equal footing, with trustless custody and oversight, programmable execution, and complete freedom in strategy design.

Flagship launch with Lido’s stETH

At launch, Core Vaults feature Lido’s stETH as the flagship strategy – Ethereum’s most battle-tested yield primitive. Lido delivers the foundation; Mellow builds the structure around it, providing modular strategy design, risk isolation, and execution precision. Anchoring the inaugural vaults to stETH affirms its role as the cornerstone of Mellow’s institutional-grade product suite and demonstrates how Core Vaults transform proven primitives into disciplined, investable strategies.

Plug-and-Play Access

In DeFi, integrations are often fragile – slow to launch and harder to adapt. Core Vaults invert that model with plug-and-play access that adapts as markets evolve. Everything is ready out of the box – protocols and exchanges connect through the vault architecture without additional lines of code that needs to be written and audited.

This design makes Core Vaults inherently adaptable. As new venues and yield primitives appear, vault admin can plug them into strategies without additional development by calling designated functions. Institutions gain the ability to respond to fast-moving markets with precision – deploying complex, risk-aware strategies as quickly as opportunities emerge.

DeFi protocols – The vault architecture is asset-agnostic and protocol-agnostic, so new strategies can be built on virtually any DeFi primitive. Beyond stETH, Core Vaults connect seamlessly to a broad range of protocols, including:

– Aave, Morpho, Gearbox, Euler, Fluid – leverage and supply-side lending

– Curve, Uniswap, Balancer – DEX liquidity provisioning

– Cowswap – trustless limit orders

– Pendle – fixed-yield and yield trading

– Symbiotic and EigenLayer – restaking and shared security markets

Because of the vault architecture, protocols require no custom adapters or additional engineering – connections come out of the box, which accelerates strategy deployment and dramatically reduces time-to-market.

Centralized Exchange Access – the key to delta-neutral

Core Vaults extend beyond DeFi into centralized exchanges through Copper ClearLoop and Binance Ceffu, supporting Binance, Bybit, Deribit, OKX, Coinbase, Gate.io, Kraken, and others.

The purpose is not just broader coverage – it is the new strategies it unlocks. Access to both DeFi and CEX liquidity inside one vault makes true delta-neutral strategies possible. Core Vaults make this possible by pairing staking or restaking exposure with offsetting positions on CEX perps or options, giving curators the tools to reduce market risk and deliver more predictable yield profiles for institutions.

Without unified CEX access, these trades require multiple systems. Core Vaults turns that into one framework – assets remain in secure settlement environments while hedges and neutral positions are executed seamlessly alongside DeFi legs.

Modular by design – the ones on board are not a fixed list. The framework eliminates engineering overhead, so new protocols, exchanges, or assets can be connected without custom adapters or redevelopment. This makes strategies adaptable: as new primitives or markets emerge, curators can incorporate them immediately into existing vaults. For institutions, this means their strategies stay current with market innovation without the cost, delay, or risk of building fresh integrations each time.

The Infinite Strategy Engine

Breadth of connected protocols alone doesn’t solve the institutional bottleneck – what matters is how they come together and composability they bring. Core Vaults unify these into a single programmable framework, turning fragmented markets into one continuous strategy surface.

This makes Core Vaults an infinite strategy engine. Curators can route capital across DeFi protocols and centralized exchanges in any combination – hedged, leveraged, cross-chain, or delta-neutral – while still operating under clear risk parameters and compliance mandates.

Instead of managing isolated positions across multiple dashboards, strategies are designed once and executed trustlessly through Core Vaults. Withdrawals, risk controls, and custody safeguards remain consistent, no matter how complex the flow.

From conservative staking portfolios to sophisticated multi-leg strategies, Core Vaults compress the operational sprawl of onchain yield into a single, institution-ready surface.

Strategy Examples – from delta-neutral income to complex plays

1) ETH staking with CEX hedge – delta-neutral yield

Vault capital is staked via Lido and restaked via Symbiotic, generating validator rewards and points. An offsetting ETH short is placed on Binance or Deribit through Copper ClearLoop or Ceffu. The position delivers staking and restaking yield while neutralizing ETH price risk – transforming restaking exposure into a dollar-denominated strategy with trustless custody and deep capacity.

2) Leveraged stablecoin carry – Spark + Ethena loop

wstETH is posted as collateral on Spark to borrow USDT. The borrowed capital is split between USDe and sUSDe, then deposited on Aave to earn supply interest plus Ethena Merkl incentives. The cycle is repeated up to 8× with re-borrowing. Revenues combine Aave supply yield, embedded sUSDe accrual, and Ethena incentives, net of Spark borrow costs. Risks include funding rate decay, leverage-driven liquidation, USDe/sUSDe peg stability, and incentive program sunset.

3) Leveraged ETH restaking – compounding with guardrails

Capital is looped through Gearbox to lever ETH exposure, then restaked on Symbiotic or EigenLayer. Yield is amplified through looping, with hedges dynamically placed on CEXes to cap downside. The strategy is contained within its own vault, isolated from other flows, with curator-defined leverage limits and instant redemption buffers.

Structured Roles, Structured Strategies

Core Vaults bring together the full spectrum of participants needed to make onchain strategies work.

LPs – Institutions, DAOs, treasuries, and retail users provide capital. In DeFi strategies, LPs always retain custody – assets remain in trustless smart contracts, never in the hands of Mellow or curators. In CEX-connected strategies, custody is managed through institutional rails such as Copper ClearLoop or Binance Ceffu, where curators operate within client-defined risk and custody frameworks.

Curators – Professional managers design and run strategies. They set parameters, allocations, and risk tiers, but act as risk managers rather than custodians.

Execution layer – Strategies run across both DeFi protocols and centralized exchanges. Core Vaults connect to each natively: DeFi protocols are supported out of the box, while CEX access is handled through institutional rails like Copper ClearLoop and Binance Ceffu.

By structuring roles this way, Core Vaults create a clean operating model: LPs supply capital, curators define strategy and act as vault admin, and execution runs across DeFi and CEX venues under a single risk-aware framework.

Deposits and withdrawals follow a predictable queue system. Users can enter or exit with one transaction, while batch processing ensures fair execution and gas efficiency. While the initial strETH vault does not use fast-track signature queues and remains fully permissionless, the framework retains the ability to enable them for clients that require it for time-sensitive strategies, where all flows are executed against fresh oracle data to prevent stale pricing.

Institutions that require compliance modules can apply them at the vault level: whitelisting assets, enforcing AML/KYC filters, or setting per-vault limits. These controls are configurable without altering the underlying trustless design – ensuring the same architecture serves both permissionless DeFi participants and regulated allocators.

Curators operate with transparency. All DeFi allocations, hedges, and rebalances are recorded onchain. For CEX strategies, execution flows through audited custodial rails. Oracles with two-tier deviation checks guard against manipulated prices, while high multisig thresholds and timelocks prevent operational pitfalls. Continuous monitoring services provide live oversight of contract integrity and vault activity.

Node operators benefit from Core Vaults not just by allocating capital, but by building strategies that align with their validation activity. They can route their own or third-party deposits into curated vaults that reinforce validator stake, attract delegations, and expand revenue opportunities across staking and restaking markets. Core Vaults provide a programmable surface for operators to connect with AVSs or SSNs while maintaining validation integrity and ensuring all capital stays trustless and risk-isolated.

The result is a clean division of roles – LPs control capital, curators control strategy, and the vault framework enforces risk discipline. Institutions can participate without compromising on custody, oversight, or operational standards.

Reshaping Onchain Yield

DeFi no longer suffers from a lack of opportunity – it suffers from fragmentation. Institutions want structured access, defined risk, and operational clarity. Core Vaults deliver exactly that.

By combining DeFi protocols and CEXes into a single programmable surface, Core Vaults transform scattered yield into structured strategies – staking and restaking to delta-neutral and leverage looping. Risk controls, oracle safety, and compliance modules are embedded, not bolted on.

This is not just another vault design – it is the framework for onchain structured products at scale. For DeFi builders, it unlocks infinite composability. For institutions, it provides the discipline, auditability, and trustless security required to allocate with confidence.

Core Vaults mark the point where vaults stop being isolated products – and become infrastructure for onchain structured finance.

The Ethena loop strategy you outlined makes a lot of sense for capital eficiency. Looping through Spark and capturing both Aave yield and Merkl incentives while managing the peg risk is exactly the kind of structured approach institutions need. USDe has proven pretty stable but tracking funding rates closely will be critical for maintaining those returns over time.