Enter modular LRTs: Mellow Protocol

Everybody knows about restaking and LRTs. But it’s important to make them work right. What do we mean by that? - “Right” is different for different user bases, it’s not a binary right-or-wrong question. In crypto, “right” is often about not picking a side as a protocol. It’s about empowering developers, integrators, and users - to choose their own “right”.

What risks to accept, what partners to work with, what operators to select - all these choices are subjective, and there shouldn’t be any one central team dictating the rules. Embrace modularity! And that’s what Mellow is doing: creating a modular infrastructure for LRTs.

In case you are not keeping up with the abbreviations:

LST: liquid staking tokens like stETH and rETH. The yield originates from the underlying network emissions according to predefined criteria, for example, see here.

LRT: liquid restaking tokens like weETH and ezETH. The yield originates, where applicable, from the same source as LSTs + on top of that, fees from AVSes / Shared Security Networks who are paying (renting) shared security.

AVS: actively validated services. Symbiotic calls them Shared Security Networks.

To make sure that the whole picture comes together, let’s start from the beginning…

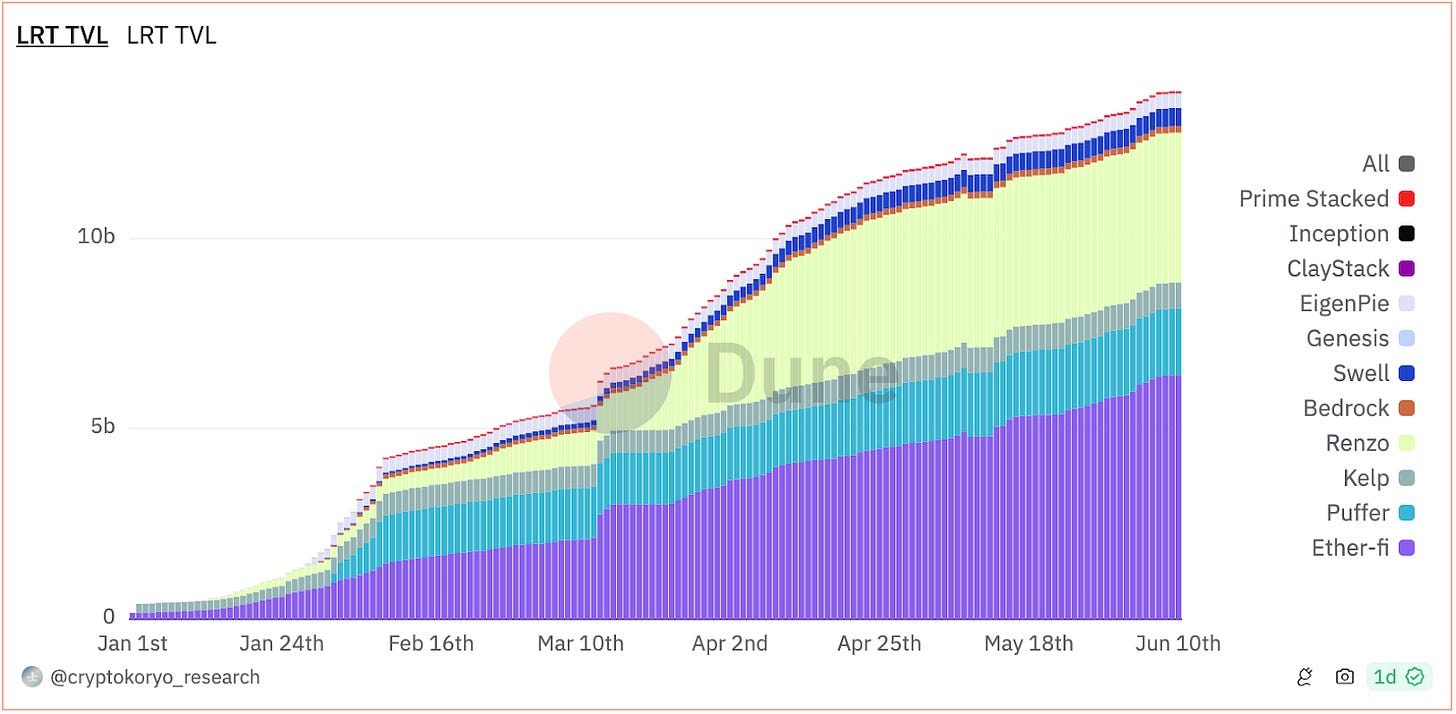

Background on restaking

Over the last 12 months, restaking has experienced notable growth, amassing a chunky portion of the ETH supply. A good part of that has settled inside native ETH restaking, potentially cannibalizing on the ETH which could have been staked in the underlying Ethereum PoS. And the reason why it happened is pretty obvious: better yields. “If you don’t know where the yield comes from, you are the yield” or so they say. So, where?

Higher yields in restaking*, versus regular staking, come from reusing staked assets to secure different Shared Security Networks / AVSes / modules**. The more work you do, the more you get paid - kind of logical. The use cases that restaking as a primitive can facilitate are numerous: validation for various modules, including consensus protocols for L2 solutions and appchains, data availability layers, virtual machines and application layers, and more. Overall, restaking as a primitive opens up new potential revenue streams for stakers.

* Note: the majority of current high yields in restaking are not due to organic demand, but due to bootstrapping the ecosystems with points and incentives. That’s fairly trivial to understand though, so we are not diving into it in this article, you all know it already.

** Note: AVS stands for actively validated services in Eigenlayer. Symbiotic calls them Shared Security Networks. For the sake of the launch blog, we will use Shared Security Networks.

Getting back to the core concept, restaking primitives address the challenges of fragmented security outside of Ethereum. It does so by aggregating ETH security to these Shared Security Networks, at the same time making Proof of Stake locked capital more efficient. Restaking provides a way for innovators to obtain shared economic security instead of establishing it from scratch. Networks can rent pooled security, thus creating an ecosystem where multiple services are secured by the “same” staked ETH rather than their own extremely volatile tokens.

In terms of rough mechanics, both the standard PoS staking as well as restaking, require locking your assets for several days or weeks in the respective protocols, meaning those assets can't be traded, used as collateral, or utilized elsewhere in DeFi strategies. Creating liquid versions of both is essential for capital efficiency, and we have seen how LSTs took off.

Speaking of LSTs, a liquid staking provider is mainly focused on providing depositors with a means of connecting with a reliable node operator, so that they can spin up validators and provide receipt tokens for staking positions. They help match capital to operators. There are numerous nuances with slashing, uptime, decentralization, and other factors - but regular LSTs undeniably come with lower risks and complexity.

On the other hand, LRT providers must also account for the risk profile of Shared Security Networks (AVSes) which they opt-in to and further expose their LRT holders to. LRTs definitely bake in more risks than regular LSTs do. They offer higher yields, but also require a much more careful approach to selecting networks, to selecting operators, to other factors.

Overall, the benefits of LRTs (Liquid Restaking Tokens) extend beyond instant liquidity. They are a way to get aggregate governance, compound yields, diversify risks, and more.

Yet, risks need to be carefully addressed. But how?

Restaking and LRT risks

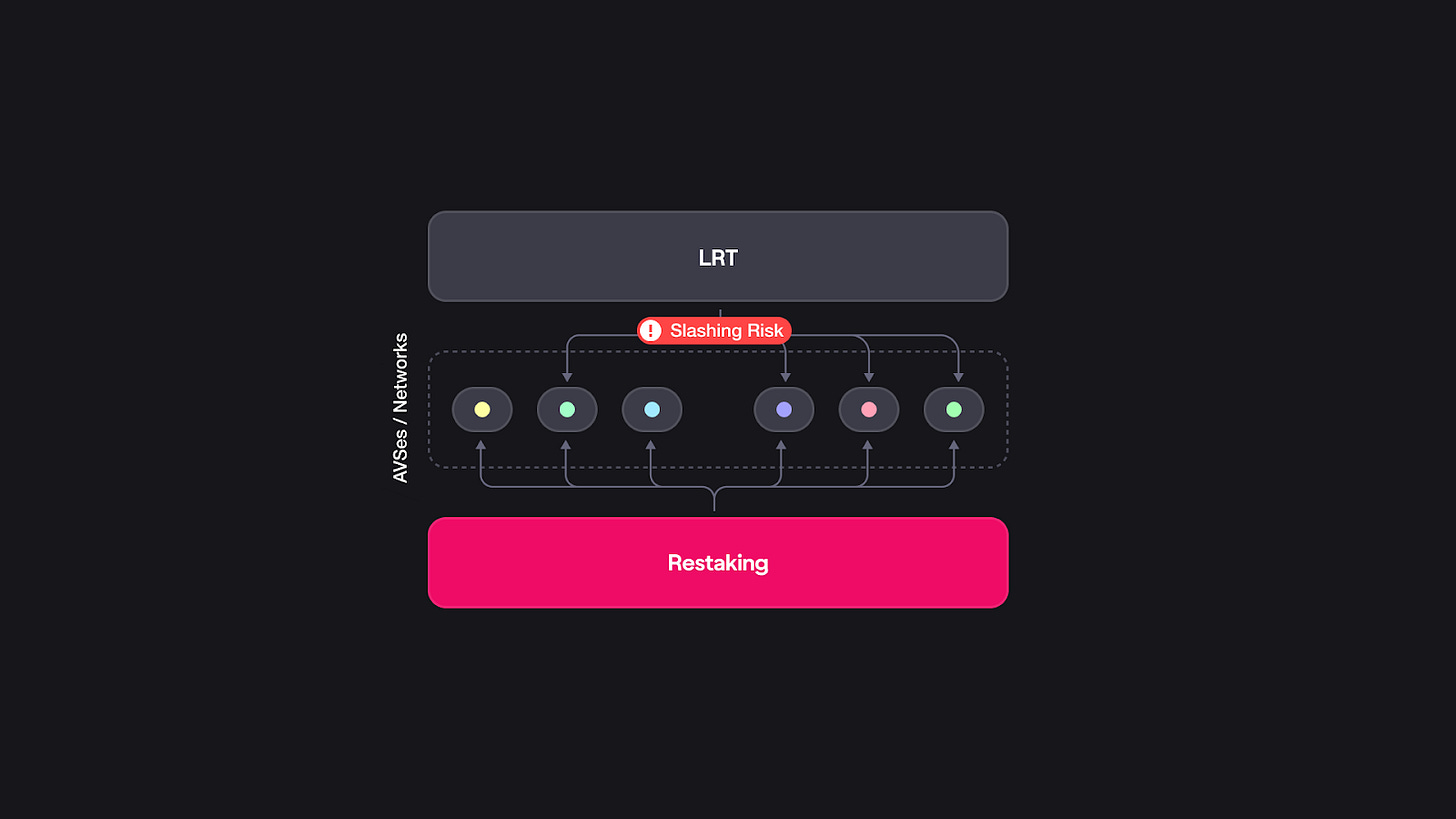

The risks could be trivial if they were standalone, but compounding them is the questionable part. Problems arise when one LRT restakes for dozens of different Shared Security Networks and keeps compounding those risks. There is no way to manifest different risk models, liquidation cascades affect everyone, the management is done by a central body, etc.

To better understand how to build risk-adjusted models and what risks to look out for, let’s dive into some of the most prolific things to consider when working with staking and LRTs.

Smart Contract Risk

Bugs in the smart contracts and logic of Shared Security Networks (or AVSes) pose a potential risk of getting slashed even unintentionally. To mitigate the smart contract risks, restaking protocols sometimes rely on governance to address issues due to unintended slashing. The governance committee can reverse the slashing that resulted from bugs or malicious code.

Different restaking protocols have different approaches. The more Shared Security Networks are bundled into one LRT, the higher risks you get overall. Compounding continuously might not be the most optimal approach, or maybe it is? - Mellow’s modularity can provide both options.

LRT looping risk that may potentially cause a liquidation cascade

A few DeFi platforms allow to take on 5-10x leverage. However, liquidity crunches can occur because of withdrawal delays of days and even weeks, which is common in staking and restaking protocols. To mitigate these risks, lending protocols are already opting in to hardcode oracles 1:1 or use oracles that look inwards into LRTs underlying backing of assets rather than simply tracking a secondary market price of the said derivative.

In general, different Networks/AVSes may have different withdrawal delays, so using a unified approach here is unlikely to work well. Again, we don’t judge. Mellow’s modular stack provides the options, and it’s the users who choose what they prefer.

Operator Centralization

One of the main concerns with restaking middleware is the risk of operator centralization. This issue arises if there are high offchain requirements for operators, potentially leading to a concentration of resources and expertise among a limited group of operators. Such a scenario could diminish the attractiveness and feasibility of solo-staking on Ethereum.

Moreover, each LRT protocol in existence determines which operator(s) should validate their pooled ETH, effectively managing the Shared Security Networks’ risks for their users. It’s too much power and control in the hands of one central body. That should be diversified.

Stimulus to increase risk among Operators

As pointed out earlier, operators can opt into various services, each offering different potential rewards. The varied reward structures might incentivize operators to focus on maximizing returns, making it hard to maintain a balanced environment for all restaking operators.

There is also an indirect cost imposed by looking for more high-paying Shared Security Networks. This problem is very similar to the performance fee that incentivises fund managers to go full risk-on and can be “solved” by adding another dimension to restaking middleware.

Slashing Risk

LRT protocols have the discretion to select which protocols to secure. Poor due diligence could lead to restaked assets being slashed if they validate malicious protocols. This is by far more significant risk, as slashing covenants may be magnitudes higher in restaking than plain staking.

Conflicting interests of LRT and governance token holders

Alignment of governance token holders and ETH restakers is vital for a successful protocol. The dilemma about revenue sharing or risk-bearing it can become a tug of war. Adding new layers of abstraction over tokenomics can be useful to align stimulus by contouring out some slashing and forking risks, but it makes the system complex and egalitarian. And we don’t know what’s behind this layer, no one has ever been there and came back yet.

Before we unveil Mellow tech, let’s reiterate:

Although current LRTs permit delegation to multiple Shared Security Networks’ operators, permissioned LRT holders and LRT node operators have little to no choice in how these delegation sets are formed or how risks are managed.

Networks, rewards distribution, and slashing mechanisms for restaking middleware - are still under development. That is why its stakeholders place stringent constraints on design and smart contract implementation due to the abysmal cost of errors.

Allowing LRT curators to issue new LRTs with refined risk/reward ratios in a permissionless manner makes the possibility of malfunctions causing ripple effects and liquidation cascades across the entire ecosystem remote and unlikely.

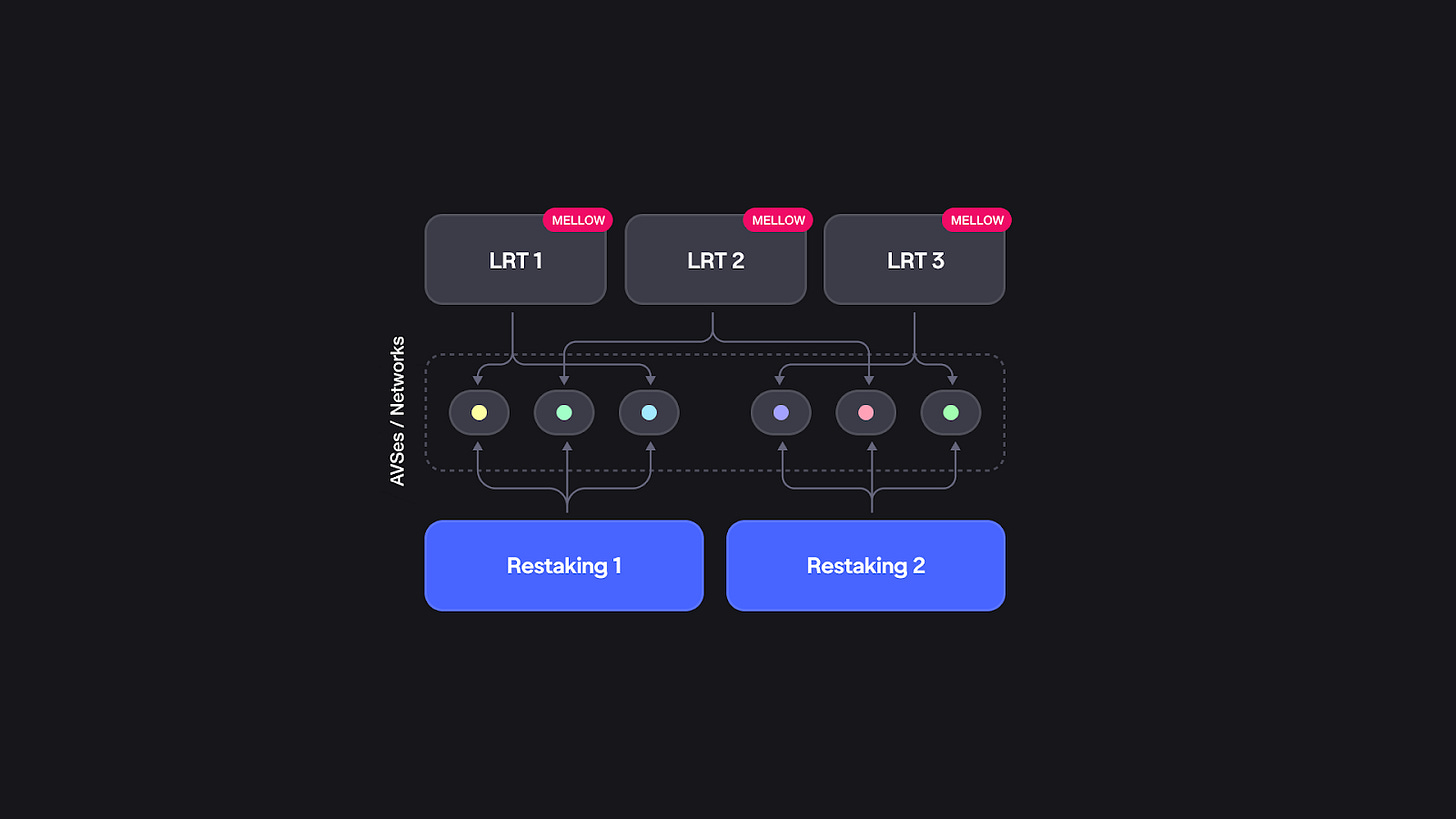

Introducing Mellow’s modular infrastructure for LRTs

As stated above, current LRTs force users into a single risk profile for opting-in into different Shared Security Networks / AVSes. This approach fails to address the diverse needs of users and tends to overexpose them to multiple risks. Some restakers can be okay with a certain level of risks, others would not. The goal should be to create different risk-adjusted baskets.

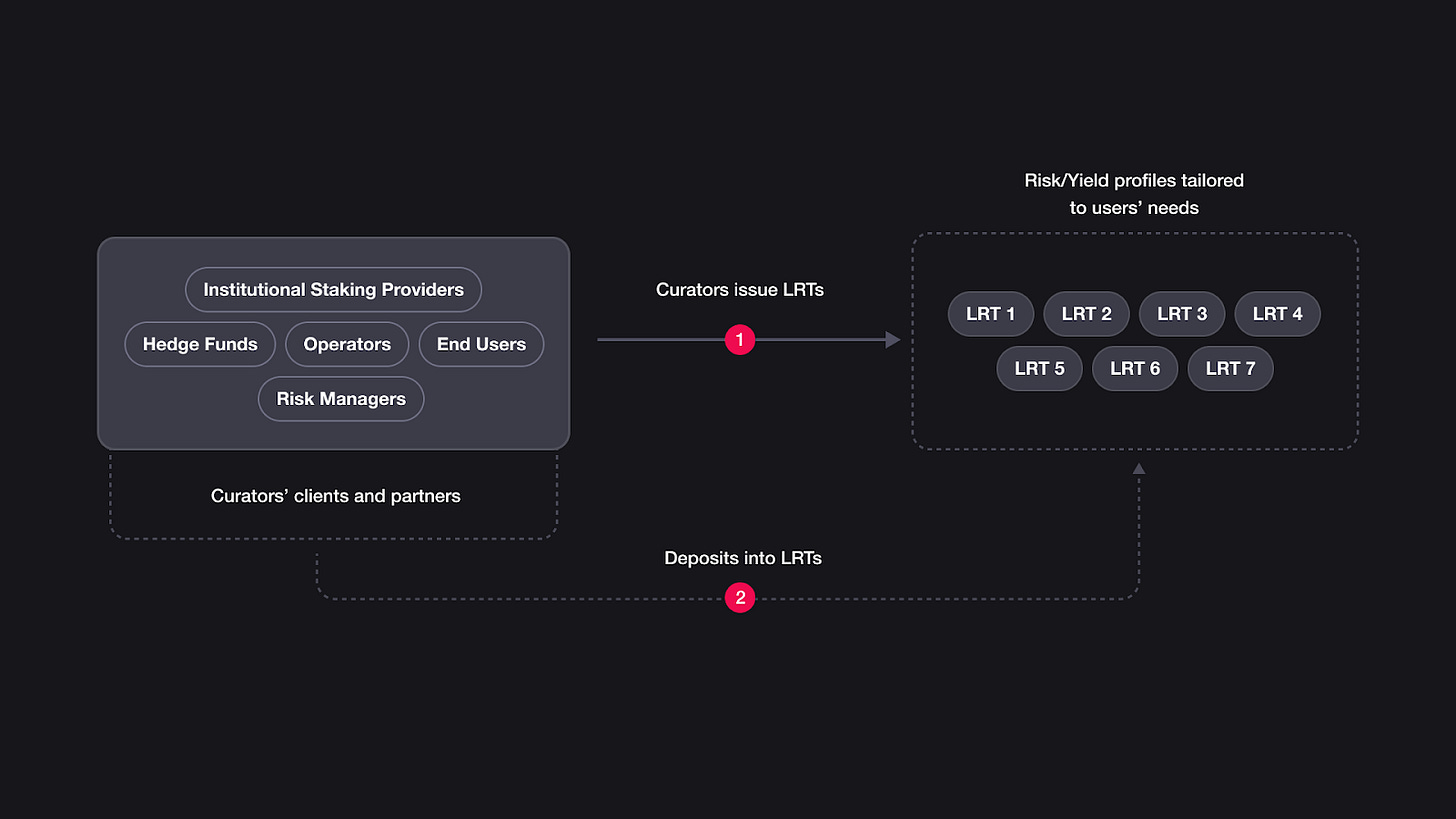

Mellow is solving these issues by externalizing risk management and allowing for a multitude of risk profiles. In terms of different user groups, see it this way:

Shared Security Networks can request what standalone assets or composition of assets (enabled by Mellow’s modular vaults) they want to see as economic security, each time tapping into different communities if needed;

Risk curators can choose Shared Security Networks to include into their LRTs;

Risk curators decide their set of operators and configure them to their best abilities;

Depositors (restakers) choose which composition and risk curators they prefer.

Due to the different risk/reward profiles already mentioned above, the issue of Shared Security Networks curation becomes critical. All current LRT solutions offer a "one-token-fits-all" approach, which clearly cannot satisfy the requirements of various segments of restakers. We solve this problem by providing a flexible liquid restaking primitive for permissionless LRT creation each with a different logic and unique risk profile. This allows modular protocol to address more diverse use cases enhancing the ability to scale.

To say more about the architecture of Mellow Protocol, it is engineered to adapt to the varying needs of its users while maintaining a high standard of security and transparency. By allowing permissionless LRT curation, Mellow enables users more choice regarding their desired level of exposure to risk, while still benefiting from the liquidity of staked assets. This is achieved by dynamically adjusting strategies within each vault based on real-time risk assessments and market conditions. These and some other material changes can be set behind a timelock.

We are serious about smart contract security and that’s why we collaborated with ChainSecurity and Statemind to deliver audit reports neatly prepared by their teams. Please keep in mind that ChainSecurity audit is still in process, but the Statemind report is already available:

Future iterations of Mellow Protocol are planned to include advanced features such as dynamic rebalancing of vault allocations to optimize risk-adjusted returns and minimize potential losses due to market volatility.

Mellow is able to function as the underlying modular infrastructure for LRTs atop of any staking protocol, be it Symbiotic, Eigenlayer, Karak, Nektar, and anyone else imagined. We are not making choices - risk curators and users do! Our job is to provide the most modular stack, so different visions can be made possible.

Risk curators and choices

Risks are about taking them or not, they are not right-or-wrong questions. You can be comfortable with the risk of getting beaten by a shark in the Red Sea, while someone else could consider it to be a silly and unnecessary risk to take. Every person has their own taste.

All of the risks explained above are choices that risk curators and their depositors will take. Mellow Protocols’ modular stack makes no judgment on what Shared Security Networks are “right”, what risks are “right”, and so on. Developers, curators, and depositors - make their own choices and decide in a transparent way on what and how to use.

Mellow Protocol offers a series of vault smart contracts tailored to different risk profiles, managed by curators. These vaults rely on the inherent flexibility, composability and security of both Ethereum and restaking providers to mitigate Shared Security Networks risks effectively. As in a truly modular solution, Mellow LRT curators choose the modules they want to validate. A curator has the option to validate as many (or as few) as they prefer, managing specific Shared Security Networks risk/rewards.

If you are familiar with the latest research in lending markets, you can consider what Mellow is doing similar to how Aave V4, Gearbox, and Morpho are approaching this. A modular infrastructure which allows for anyone to use the stack in the way they want, for risk curators to decide on risks, and for depositors to pick which risk-adjusted models they prefer.

Who is joining Mellow as risk curators? Almost everyone, see below!

Mellow ecosystem

Mellow Protocol has been around for a while. We are humbled to have amassed a great group of like-minded developers and friends. Reputable and big-brain risk curators joining Mellow, DeFi protocol integrations are cooking up, and all other things shall gradually be unraveled. Want to work together? Get in touch, would be glad to chat about different opportunities!

Lido Alliance

https://twitter.com/mellowprotocol/status/1798814932592664855

Utilizing its underlying protocol, Mellow will aid Lido operators in launching their own LRTs, which will bring value to Lido DAO members by growing stETH usability and adding an extra layer of revenue for Lido operators. Mellow will support LRTs issued using Mellow tech, collaborating with Lido operators on DeFi integrations, and aiding with onboarding new LRTs.

Restaking launch partner: Symbiotic

Our vision of autonomy and modularity is exceptionally aligned with Symbiotic, a novel restaking protocol that allows for restaking to be truly permissionless. To many technical teams and researchers it doesn’t come as a surprise, as they have been in development for a long time. We’ve chosen them as our launch partner as their architecture and similar modular approach to restaking enable Mellow Protocol to showcase its strongest features.

Symbiotic smart contracts are immutable, but at the same time, service builders are not tied with proprietary setups while locking into security frameworks with various operator sets, slashing, and rewards logic. All these features make it a perfect fit for Mellow LRTs, providing the flexibility that our system needs to bring diverse risk profiles to the users.

Launch details

Wen launch ser? - Now. Mellow Protocol is live!

Check it out and deposit: https://mellow.finance/

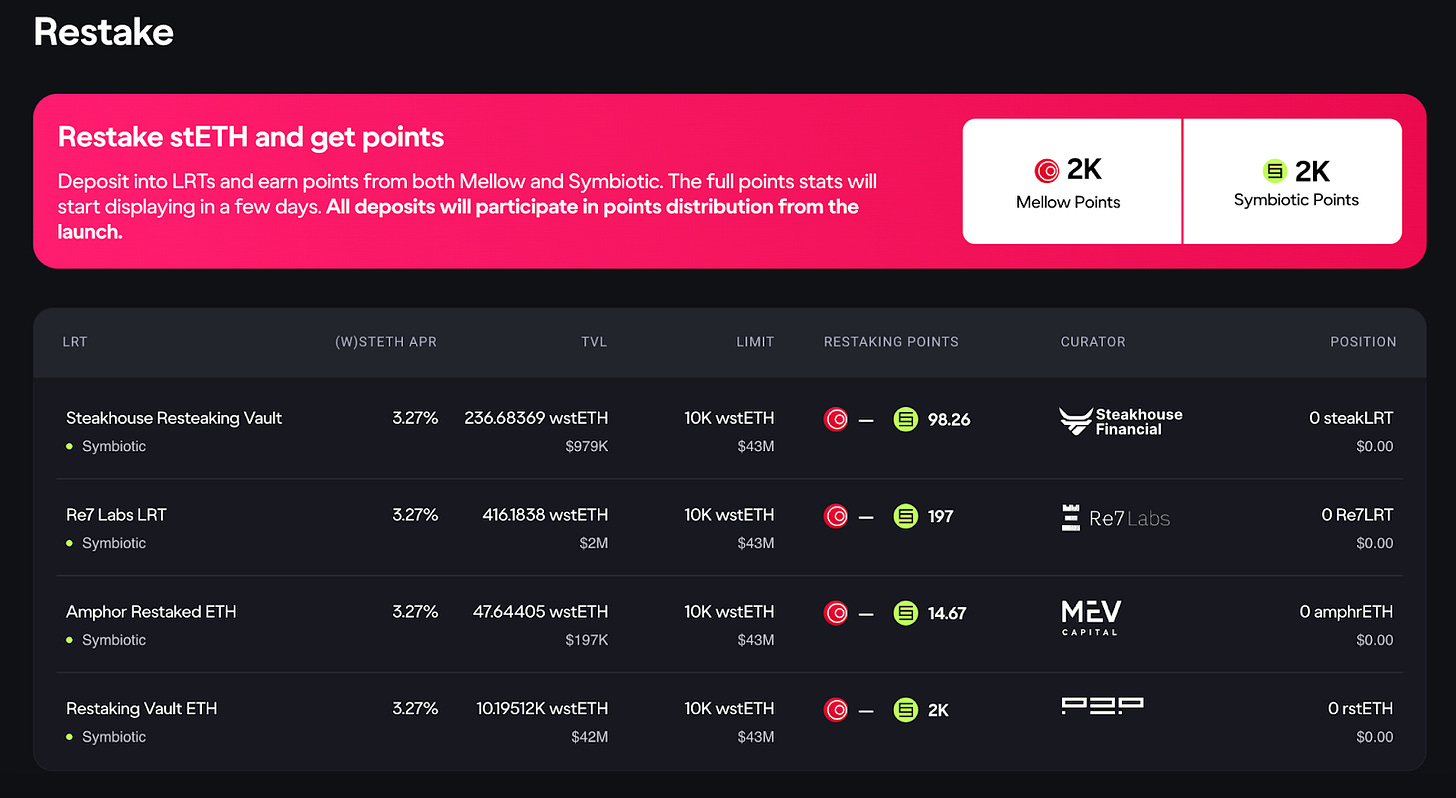

At launch, the following risk curator partners are kicking off their vaults with Mellow:

Steakhouse

P2P

Re7 Labs

MEV Capital

By design and thanks to the modularity of Mellow, each LRT shall be tailored to reflect different risk profiles based on a curator's goals and value proposition, enabling users to choose their personalized risk exposure. This approach addresses a significant limitation of monolithic LRTs, where all users are forced into a one-size-fits-all risk profile, regardless of their risk tolerance.

Each of their respective vaults will be capped at 10322.5 stETH and initially, stETH will be the only asset to deposit into these vaults. As you can see in the dApp, stETH/wstETH/ETH/WETH are accepted, but the dApp simply helps you wrap those into stETH first, and then restakes it.

Later on, it could practically be any asset securing the Networks. More details and docs on the integrations will follow shortly.

Points? - Yes, points. Both Symbiotic and Mellow points start occurring immediately. The dashboards to see your stats will not be fully accurate at first. But just so you know, both points are already accruing to stakers-depositors in these respective Mellow vaults. How many, at what speed, when new assets, when do rules change and other details - will be posted in the coming days. Keep an eye on socials to stay up-to-date.

Check docs, code, and become part of the Mellow ecosystem! What mascot shall we have? We are still thinking about it. Let us know in Discord.

Discord: https://discord.com/invite/mellow

Twitter: https://x.com/Mellowprotocol

Website: https://mellow.finance/

Substack: https://mellowprotocol.substack.com/