Mellow Interop Vaults – Unlocking Yield on Ethereum Mainnet from Any Chain

In the evolving landscape of DeFi, Ethereum mainnet remains the core settlement layer, hosting restaking protocols and other essential foundational infrastructure. But as EVM ecosystems scale horizontally, the need to access mainnet infrastructure from L2s becomes a design challenge.

For EVM users and institutions operating across L2s, this often means bridging, paying high gas, managing new wallets, and losing exposure to their home chain’s ecosystem – making it more than just a UX problem, but a capital allocation problem. For everyday users, it's too complex. For institutions, it's operationally nonviable.

Mellow interop vaults remove these barriers, acting as a trustless gateway from any EVM chain to mainnet yield. Powered by LayerZero’s OFT standard, they abstract away bridging and routing logic, letting users stay on their preferred chain while vaults do the heavy lifting.

We’re turning any EVM chain into a restaking-enabled yield layer – instantly and without compromise.

When Bridging Doesn’t Deliver

As it exists today, bridging is not the UX that you desire. The moment a user sends assets cross-chain, they break the integrations, automations, and composable context that make DeFi efficient. It introduces fragmentation, delays, and risk – whether through user error or the bridge itself.

Bridges are also operational overhead. To meet the highest security standards, institutions need audit trails, clear custody, and minimal touchpoints to fit the toughest security demands – not layers of additional infrastructure.

For L2s and EVM-compatible chains, local liquidity is growth-critical for ecosystems. Bridging drains capital, breaks onchain integrations, and sidelines ecosystem-native apps and tooling. This weakens both the chain’s traction and its long-term developer incentives. The result is fragmented experiences and weakened ecosystem gravity.

That’s why multi-chain yield strategies have struggled to gain traction.

Enter OFT-Enabled Interop Vaults

Mellow fixes this by integrating LayerZero’s OFT (Omnichain Fungible Token) adapter. By using cross-chain messaging and OFT minting, Mellow vaults become natively cross-chain. There is no bridging interface, no need for wrapped assets, and no user-side complexity.

From any EVM chain, users can access mainnet infrastructure and receive vault shares locally – no bridging needed. These shares remain composable with local DeFi apps and can be used as collateral or held for long-term exposure.

Assets stay on their source chain – while restaking and strategy execution run on mainnet. As a result, ecosystems retain liquidity, and users and institutions unlock Ethereum’s full restaking infrastructure while avoiding operational complexity. No bridges. No compromise.

Use Cases: Unlocking Cross-Chain Capital Efficiency

This is more than technical interoperability – it’s practical capital mobility across chains. Mellow interop vaults open up a new design space for users and institutions alike.

An EVM chain user can delegate assets into a Mellow interop vault targeting Symbiotic’s SSNs. The user receives a yield-bearing asset on the source chain, while capital is delegated to SSNs. No bridging required, no exposure lost.

For liquidity providers on L2s, vaults abstract away bridging, execution, and custody frictions – letting capital stay where it’s managed while accessing mainnet infrastructure and restaking under the hood. The vault becomes a programmable cross-chain router for permissionless yield flows.

How It Works

Mellow interop vaults are built upon LayerZero's OFT standard, enabling seamless cross-chain interactions without the need for traditional bridging. You deposit once. A secure message routes your intent to the target chain, where Mellow deploys your capital into curated yield strategies.

The mechanism is simple:

Users deposit on any EVM chain

Users deposit assets into a Mellow vault on their preferred EVM chain. These deposits go through SourceCore contract, which tracks all value – including what’s held locally, sent across, or already staked on the target chain.Cross-chain message is sent

Instead of moving tokens, a message is sent via LayerZero to the target chain. This message contains instructions about how the user’s capital should be allocated.Capital is deployed on L1

On the target chain, the message is received by MellowOFT, which passes it to TargetCore. Funds are then deployed across different yield strategies.Users receive vault shares on L2

Back on the source chain, users get shares that represent their position in the vault. These shares can be used natively on their EVM chain, and users can withdraw later using Mellow’s custom queuing system.

Why It Matters

Mainnet restaking protocols represent the core of Ethereum’s yield infrastructure – but accessing them has historically come at a cost: bridging complexity, fragmented custody, and broken composability.

Mellow interop vaults close this gap. They let any EVM chain access mainnet restaking strategies – directly, trustlessly, and without bridging. Assets stay on their source chain, while capital is deployed into infrastructure like Lido or Symbiotic on Ethereum. Users receive vault shares locally, composable with ecosystem-native apps and tooling.

This unlocks a new tier of capital efficiency. EVM chains no longer lose liquidity to mainnet. Users don’t face complex bridging flows or fragmented custody. Institutions get auditability, minimal operational overhead, and access to the full Ethereum restaking economy from any chain.

For ecosystems, this reinforces local gravity – liquidity stays native, integrations stay intact, and developers can build on a composable yield layer without compromising user flow.

Mellow turns every EVM chain into a first-class participant in Ethereum restaking – modular, trustless, and institutional-ready by design.

This isn’t a patch on cross-chain fragmentation. It’s the foundation for a unified, yield-connected DeFi economy.

How Mellow Interop Vaults Work – A Technical Deep Dive

Mellow interop vaults are designed to make mainnet-native yield accessible to users on any EVM-compatible chain – without requiring direct asset bridging. Under the hood, this is achieved through a layered system powered by LayerZero’s OFT standard, a custom SourceCore vault architecture, and a cross-chain oracle-secured accounting model.

Cross-Chain Architecture

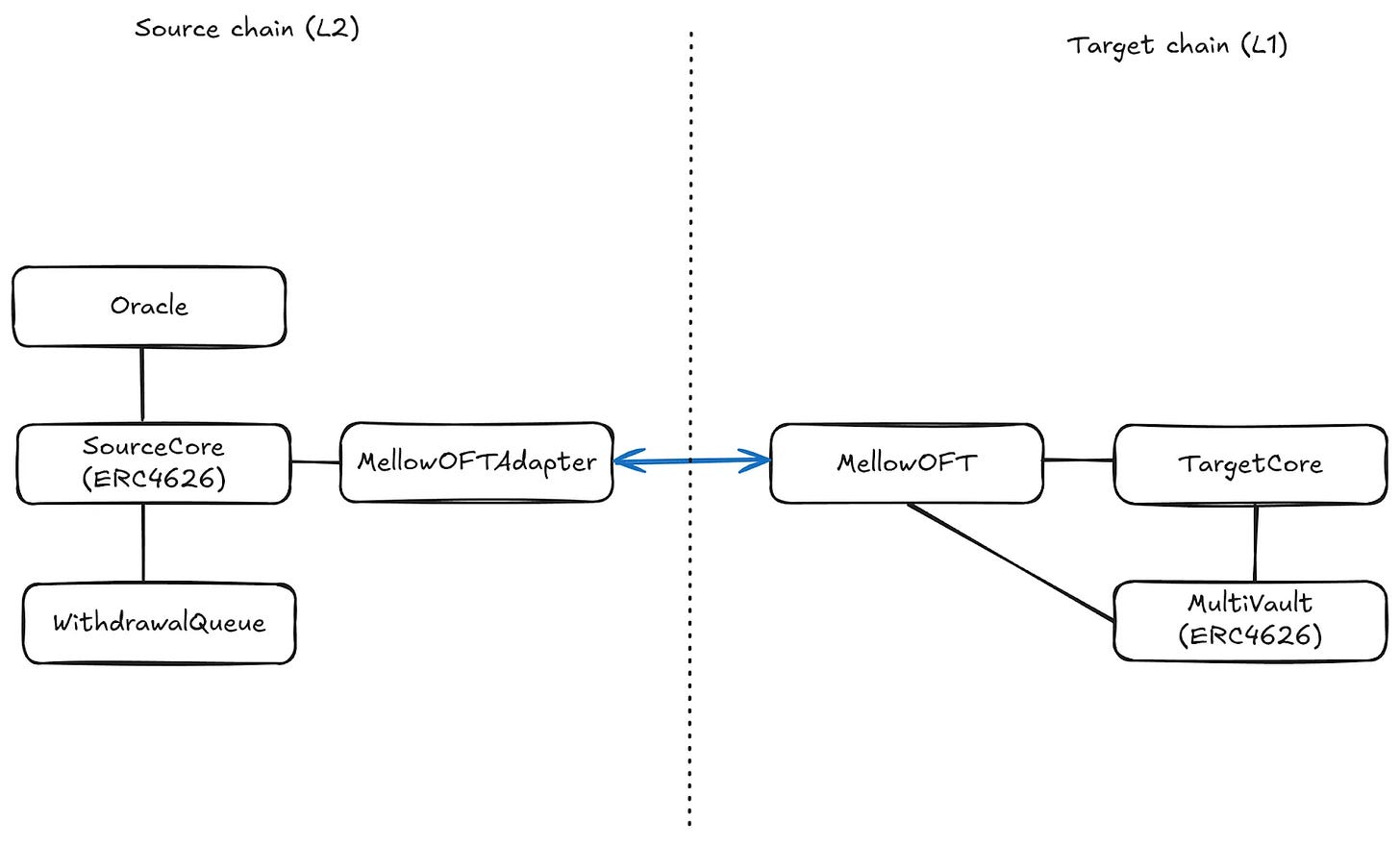

The system splits operations between two domains:

Source Chain (e.g. Lisk, Arbitrum, Base): Where users deposit assets and receive yield-bearing vault shares.

Target Chain (Ethereum Mainnet or other EVM chain): Where deposits are delegated into yield strategies managed by Mellow’s MultiVault infrastructure.

The key interaction bridge is LayerZero’s OFT protocol – adapted with strict access controls to ensure all deposits flow through Mellow’s SourceCore.

SourceCore and Vault Shares

On the source chain, the user interacts with the SourceCore contract – an ERC4626-compatible vault extended with epoch-based withdrawal mechanics and cross-chain accounting. When users deposit, they receive vault shares representing proportional ownership of a distributed yield strategy executed on mainnet.

The SourceCore vault tracks its totalAssets using a cross-chain Oracle. This Oracle computes the total value of:

Assets held directly by SourceCore

Liquidity deployed on the target chain (TargetCore)

In-transit assets moving via LayerZero

To ensure integrity, the Oracle reverts if data becomes stale – protecting users from mispriced vault share issuance or redemptions.

Epoch-Based Withdrawals

Withdrawals follow a delayed epoch system, minimizing cross-chain liquidity churn and reducing operator gas costs. When a user submits a withdrawal request, the vault queues it for fulfillment at the end of the current epoch plus a predefined withdrawalDelay.

At the end of each epoch, liquidity in SourceCore is used to fulfill as many withdrawals as possible. If demand exceeds local liquidity, funds are redeemed from mainnet by calling TargetCore, which unwinds positions in MultiVault and forwards assets back via OFT.

TargetCore and MultiVault Strategies

The TargetCore contract on mainnet serves as the execution layer:

Accepts cross-chain liquidity pushed from L2s

Allocates it into active MultiVault strategies

Supports permissioned redemption, claiming, and rebalancing operations

Withdrawals initiated from L2s are processed here, with results routed back to SourceCore.

Operator Coordination and Oracle Sync

An off-chain operator monitors net flows between deposits and withdrawals, orchestrating liquidity movement between chains. This involves:

Pushing excess deposits to mainnet

Redeeming and returning funds when L2-side withdrawals spike

Updating the Oracle to reflect real-time portfolio value across all layers

Transfers via LayerZero typically settle within hours – far faster than the 1–2 week redemption delay of most mainnet protocols. This allows the Oracle to remain accurate and responsive, with updates expected every few hours during active cycles.

What’s Next

The interop layer is live, unlocking restaking for any EVM-compatible chains. As the infrastructure evolves, we can anticipate broader adoption and the development of more sophisticated cross-chain strategies, further democratizing access to high-yield opportunities across the blockchain landscape.

Mellow will continue to expand support for more vaults, more chains, and more types of strategies – from restaking to lending markets to structured DeFi products.

This is just step one in building institutional-grade infrastructure for cross-chain yield. A cross-chain yield bazaar.