Mellow Vision for Permissionless Onchain Structured Products

Mellow is building a modular platform designed to power the creation of structured products that deliver onchain yield across diverse risk profiles. Our vision is based on the experiences of TradFi and the natural evolution of the yield markets, dictating the shape and form of the product. The ecosystem of primitives enables anyone to design and share their financial products with users almost effortlessly. The protocol is permissionless and compatible with any asset, making it adaptable to any underlying present or future use cases.

What are structured products?

Structured products are vital components of traditional finance: sophisticated financial instruments that provide tailored risk-return profiles by combining traditional assets, such as bonds or equities, with derivatives. With their help, investors can get more capital protection, enhanced yields, or exposure to otherwise inaccessible markets and strategies. They also provide portfolio diversification and risk management, catering to both retail and institutional clients seeking customized solutions in a dynamic market environment.

If you ever bought market indices in a bank or some rebalancing ETFs, then those are structured products too. It’s all structured finance!

Layers of DeFi complexity

While the Web3 narrative extends into new spheres like AI, DeSci, Social, RWA, and Data, we believe that Finance will remain the industry’s main pillar, thanks to Crypto’s nature and original framework of quantifying any transaction for any protocol from a financial perspective. At the same time, yield-generating assets are central to this process as they underpin the ecosystems value proposition. These assets drive liquidity, incentivize participation, and sustain the decentralized infrastructure by aligning user interests with protocol growth. They also foster capital efficiency and the creation of robust network effects.

Yield-generating assets in practice are represented in many shapes and forms, such as: staking, restaking, lending, liquidity provisions, incentive farming, bonding & vesting, revenue-sharing tokens, and more, - the list is continually expanding. All the listed yield mechanisms can’t exist without the extensive ecosystems that support them: risk curation, BD & integrations, infrastructure, liquidity provision, oracles, bridge operators and legal advisors.

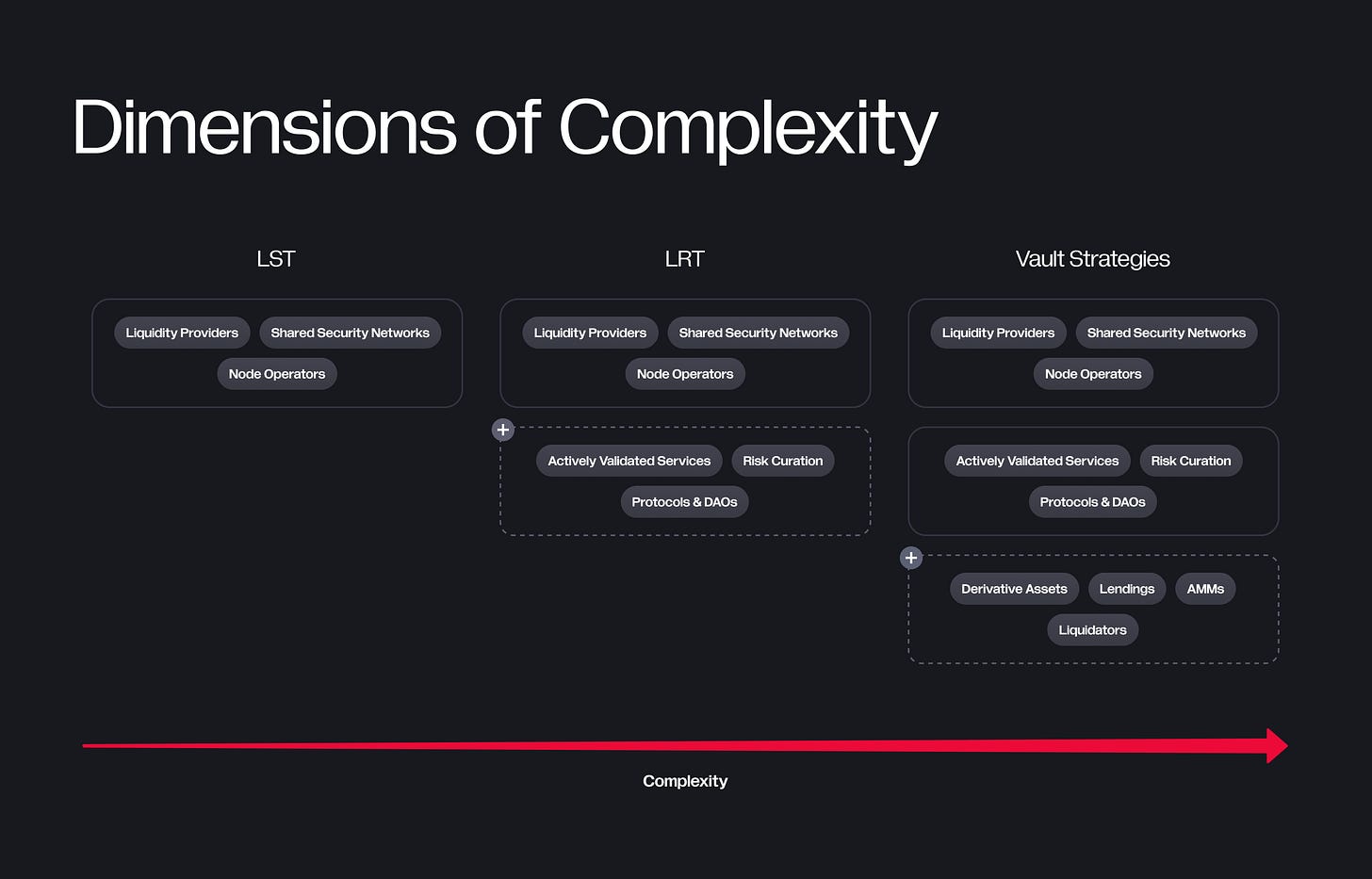

With each megacycle there are new layers and dimensions of complexity being added to the existing models and tools, making them restrictive or even impenetrable for the market participants.

TradFi takeaways

Innovation can’t come on its own: one way or another, everything is built based on experiences and interactions we already had before. The same applies for DeFi tooling. In TradFi, the structured products market is well-established and among the world’s largest, led by giants like BlackRock and Vanguard. They offer tailored risk/reward profiles to their customers in the financial sector.

In a centralized world, achieving the scale of BlackRock or Vanguard is rare. However, in Crypto, it becomes possible due to accessibility to different markets, fewer entry barriers, and a more transparent ecosystem in general.

From a Web3 standpoint, such complex products can be built by node operators, onchain liquid funds, protocols, DAOs and ecosystems. At the same time, there is a conspicuous trend in traditional finance toward easing cryptocurrency regulations, which will improve access to onchain yield for traditional institutions. As banks and funds enter the crypto space, more capital and attention will flow into these markets.

Commoditizing Onchain Yield

Mellow’s mission is to develop foundational primitives that will empower these participants to capture significant value from the entirety of the choices provided by the market while streamlining the operational and business processes and eliminating entry barriers. We are building a medium that will be native both for core crypto audiences and institutions alike.

Imagine a much freer market where multiple entities can launch products in a matter of weeks or even days – rather than months or years – improving market efficiency and benefiting LPs.

Currently, the crypto market is structured in a way that yield providers (protocols and networks) are integrated into the financial vertical at lower levels, making growth and vertical integration complex and time-consuming: besides technological complexities, such as required infrastructure, interoperability and smart contract security, there are significant challenges stemming from disorganized business practices and the tangled network of inter-entity relationships which creates friction. We see our role in changing that by interconnecting all players in the ecosystem and driving vertical integration practices to a new level.

Every big idea is followed by implementation, and usually, the quality of the implementation determines the exact path the narrative takes. In our case, the core product is an ecosystem for launching structured products with on-chain yield. Let’s touch on some of the specific details of the implementation and features that are going to be available from day one.

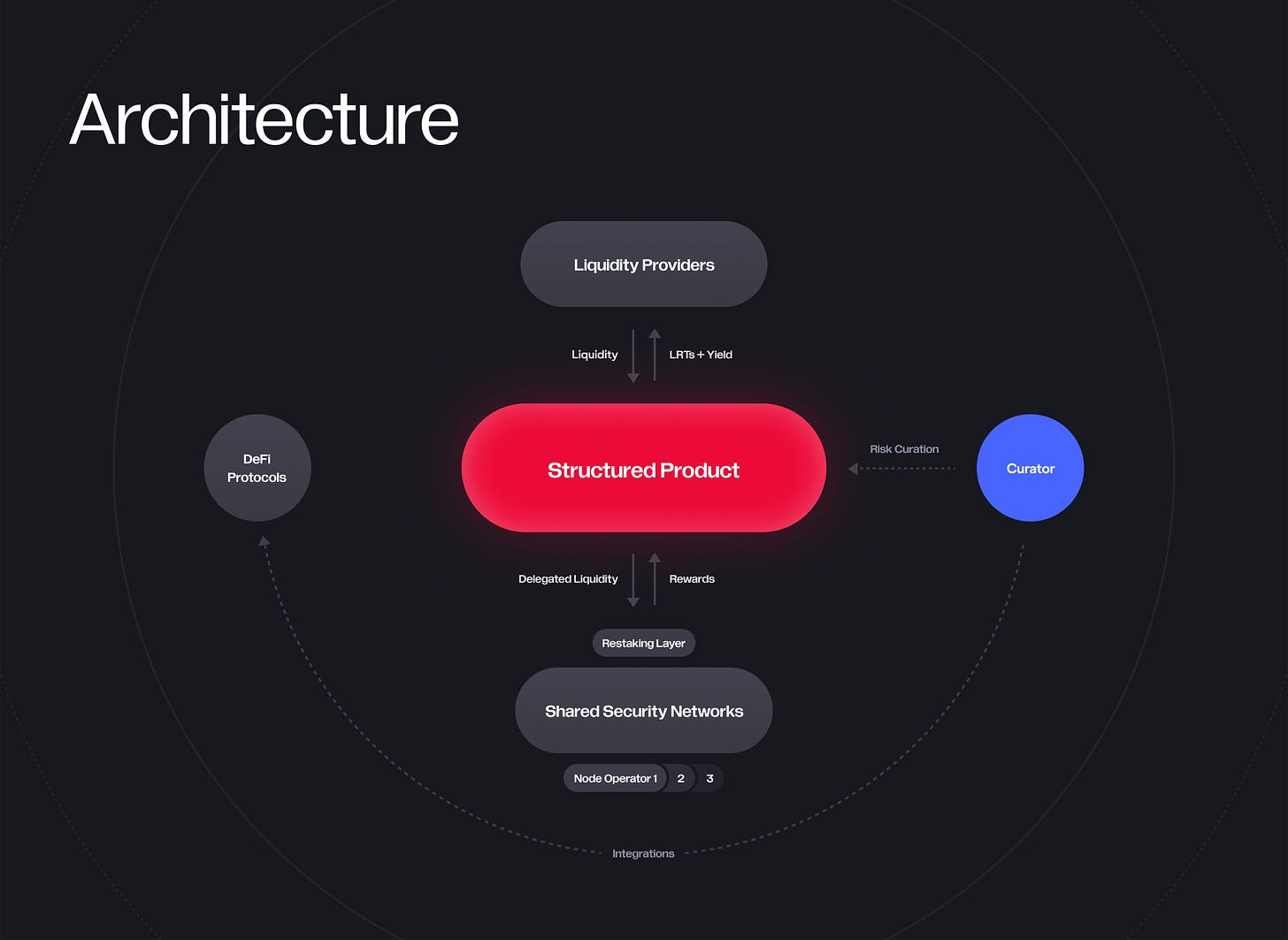

Mellow will help protocols, SSNs, and AVSes gain broader access to ecosystems by offering ready-made integrations with capital sources and the secondary market, making it an outstanding liquidity distribution channel. Curators will oversee all of this.

Curators serve as the cornerstone of the business. They drive ecosystems forward by introducing a wider range of integrated networks, protocols and other entities on the demand side, while simultaneously providing capital to support them.

Institutional-Grade Vaults

Mellow MultiVault is the heart of the system that can be expanded with multiple integrations supported by Vault’s adapters.

The vault system incorporates adapters for Symbiotic and EigenLayer and the same time supports ERC-4626 for any kind of custom integrations that can be added later, to enable the looping of assets under the hood or connect new yield sources/strategies.

The ERC-4626 adapter enables the vault system to continuously expand its integration capabilities, incorporating new protocols and strategies beyond restaking. This makes the system more adaptable and provides a comprehensive framework for creating structured products.

The current implementation is designed to be launched with multiple instances and multiple curators, supporting almost any kind of asset and interoperability in its core.

Curators can rebalance the stake across multiple sub-vaults and strategies within a single Vault while managing delegations. This implementation enables efficient control of multiple sub-vaults and facilitates the creation of tailored risk/yield profiles.

Permissionless Agenda is Taking Over

The environment we strive to create requires to be permissionless to be truly decentralized, agnostic, and fair. Same way Uniswap introduced a permissionless model for trading – we’re introducing a permissionless model for structured products that enables the market participants to freely build on top and launch their own products, using the underlying nativity.

Any participants will be able to develop their own ecosystem and business verticals using the Mellow stack, creating strong network effects.

Our role is to help grow these businesses, aggregate the products, improve secondary market liquidity, bring more users to our curators and ultimately cater to every new need of the market, constantly adding new primitives, would it be a new layer to integrate or an addition of autonomous AI agents. With a single goal of providing maximum capital efficiency.

All of that creates Onchain Structured Products, that take the best aspects of Web3 and TradFi and mold them into the new generation of financial tooling.

Want to know more about Mellow Protocol? Find us at:

Discord: https://discord.com/invite/mellow/

X/Twitter: https://x.com/Mellowprotocol/

Website: https://mellow.finance/