Aggregation & Isolation of Risks in Restaking Markets

In the last article, we shared the overall vision behind Mellow’s modular LRT infrastructure layer. In this article, we want to dive deeper into the advantages of Mellow’s approach. We believe (of course we do) that Mellow Protocol is a vital part of the restaking ecosystem, allowing it to scale without leading to risks and over-centralization. In this piece we consider Mellow from the perspective of one-stop-shop for entering the restaking space for various players.

Restaking Hub

Imagine building a service on top of restaking. You would need to integrate with the restaking protocol itself (or multiple protocols), find on operator, onboard and set up various pieces of infrastructure for your SSN/AVS, get access to liquidity, and more—these are all must-haves that slow down your time-to-market. Mellow provides a unified integration service that you can use as a white-label solution, allowing you to focus on key features. Here are some integrations Mellow can provide:

Integration with restaking layer

Liquidity management within and between different providers

Risk management for AVS and node providers

Secondary market and DeFi infrastructure

Aggregation layers on top of LRTs

By building with the Mellow stack, you can utilize any of Mellow’s modular layers, reusing our primitives in various ways. This addresses the exponential complexity of managing restaking middleware for each use case. Let’s explore how Mellow can reshape the restaking space by providing core primitives for commoditizing consensus.

Mellow’s Approach

There are two ways to earn restaking yield. The first is native restaking, where the user directly stakes an asset in the restaking protocol and subsequently manages their stake. This involves analyzing the slashing risks of various SSNs/AVSes, evaluating the quality of service provided by operators, and choosing an operator based on their preferences. The second approach involves staking the asset in an LRT protocol, where the user receives a liquid asset in return. This liquid asset can then be used in DeFi, increasing the user’s capital efficiency. The downside is that the user does not have a choice regarding their risk profile—they must accept the risk profile set by the protocol.

This raises the following questions: is it possible to combine the best of both worlds? Can we create a liquid derivative that offers users a broad choice of risk profiles while freeing them from the need to manage restaking directly? That’s what Mellow is for.

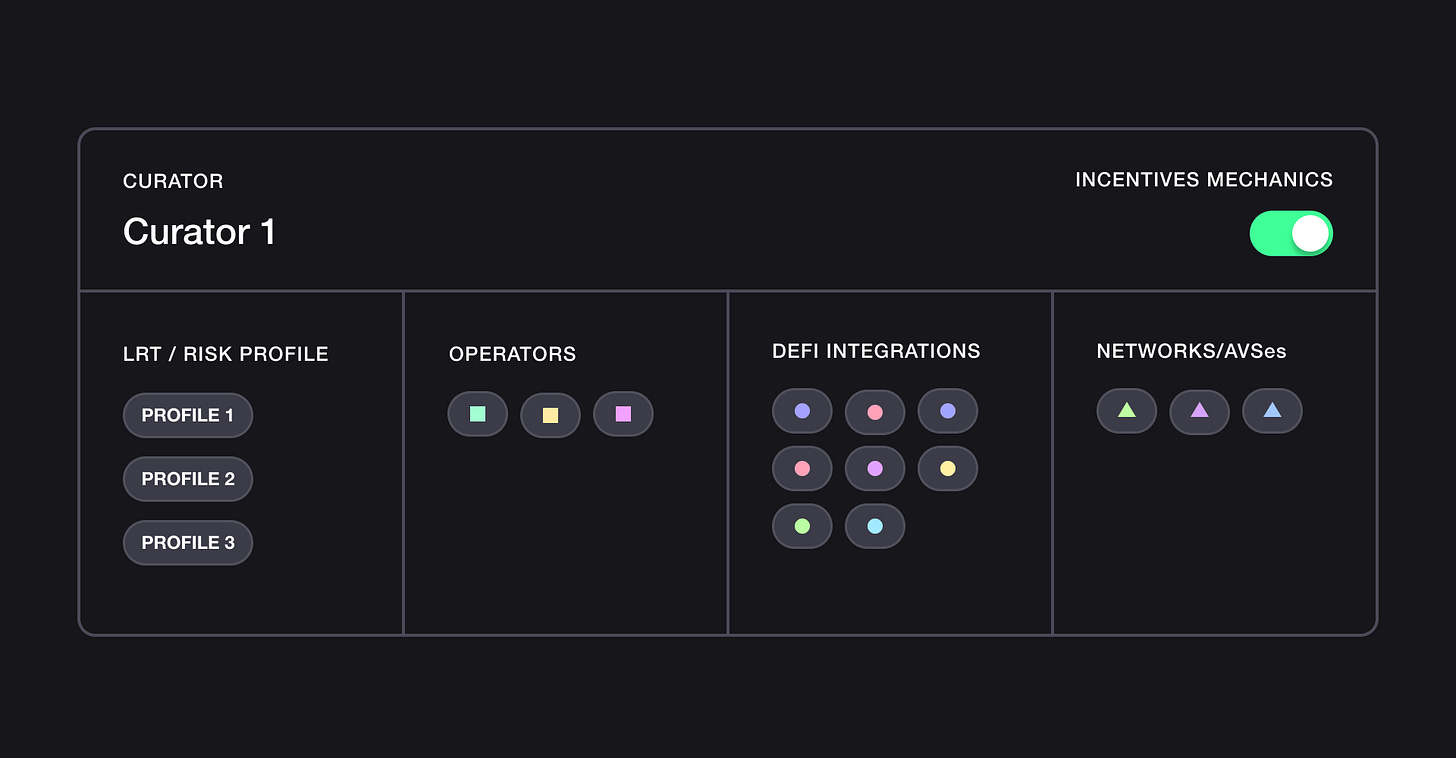

Shared Security Networks demand a distributed set of node operators to offer trust-minimized services. At Mellow, we are designing UX for SSNs to integrate stakers, curators, and operators within a single vertical. Our main objective is to commoditize consensus, and we are aligned with restaking protocols on this goal.

You can’t create a single risk profile and think it’s the best one out there. Every user has their own risk tolerance, and the goal of a primitive is to foster choices and make them openly accessible. Our goal is not to make choices for users but rather to let risk curators do their job while users decide which curators they prefer to delegate risk management to.

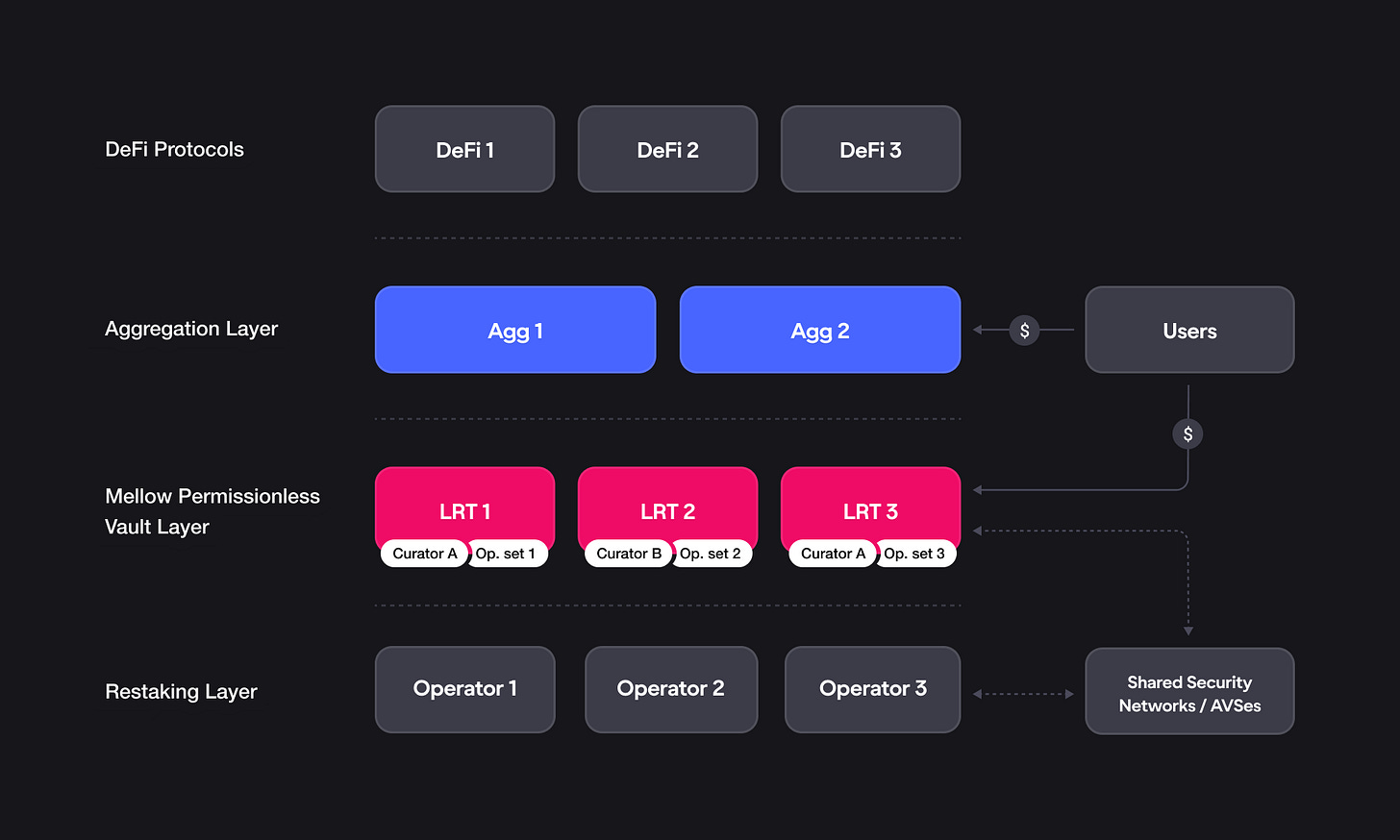

An LRT primitive, meaning Mellow Protocol, provides the infrastructure for creating risk-curated LRTs. The aggregation layer is responsible for pooling liquidity among various LRTs, similar to how Aave V4, Morpho, and Gearbox approach modular lending today.

This picture is probably familiar to experienced DeFi enthusiasts. Let us show how the Mellow modular approach is applied for better management of slashing risks and restaking returns.

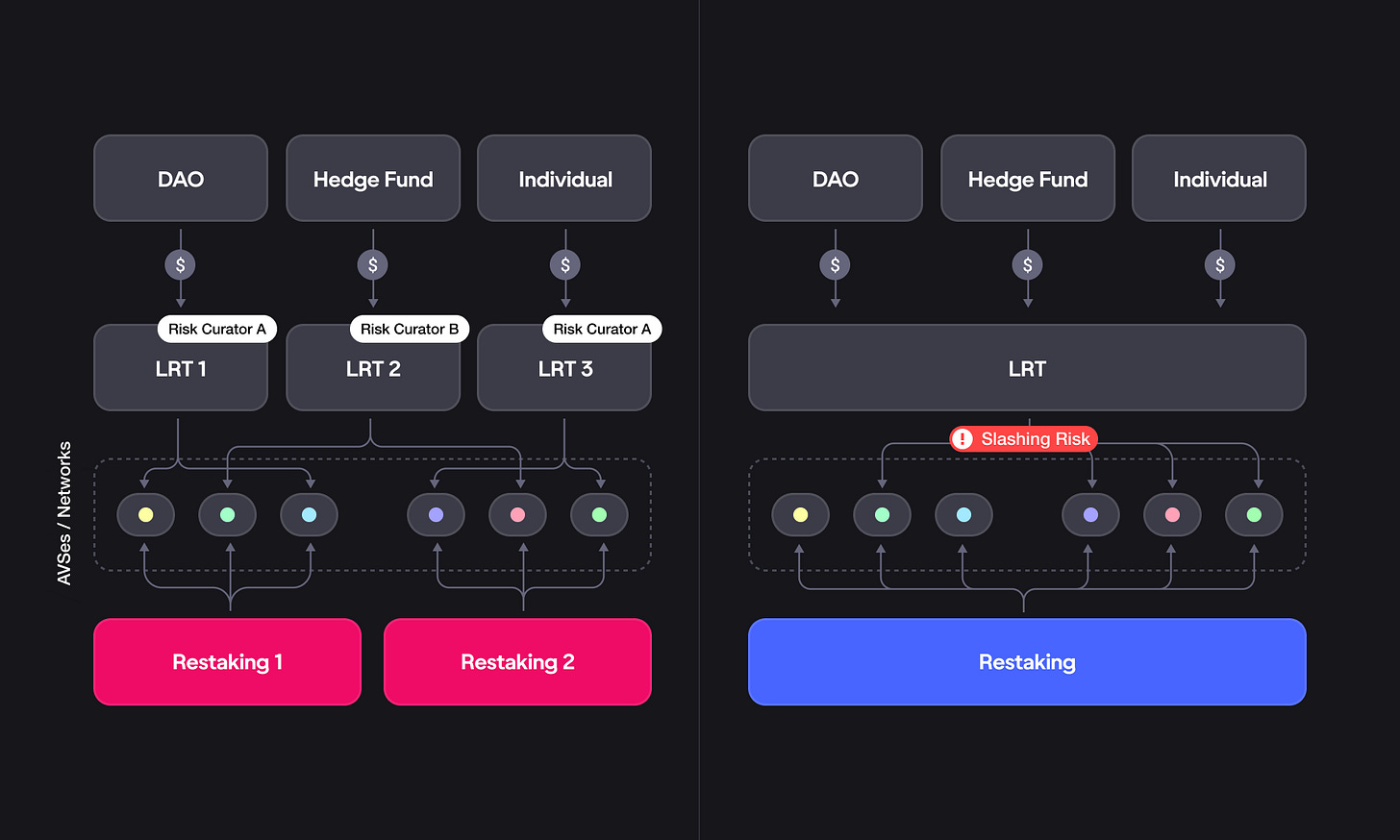

Risk Isolation

The Mellow LRT primitive enables the creation of isolated vaults with their own risk curation. This approach implies that there will be a large number of different derivatives/vaults, each with a unique risk profile. This ensures risk isolation by allowing each user to allocate capital in the vault(s) that match their risk profile the best. The Mellow LRT primitive acts as the minimum level of abstraction for creating custom derivative tokens and vaults.

However, this model can lead to liquidity fragmentation, which can constrain the amount of value that protocol usage brings. Having a wide selection of LRTs can dilute user focus, making it harder for them to choose, and the fragmentation of liquidity among many vaults can reduce the incentive for issuers and risk curators to create and manage LRTs. To address this issue, an additional layer exists on top—the Liquidity Aggregation layer.

Liquidity Aggregation

The liquidity aggregation layer allows for the creation of unified liquidity on top of the LRT layer. This aggregation can follow various logics, such as minimizing risk, maximizing yield, or enhancing the broader market utility of liquid derivatives, particularly in DeFi.

For example, major staking providers can scale their product by creating nodes that validate different sets of SSNs/AVSes, each with distinct risk/reward profiles. The aggregation layer can combine services with similar risk profiles from various providers, ensuring the necessary level of service decentralization, similar to how Lido works with numerous Node Providers to decentralize stETH.

This combination of risk-isolated vaults and liquidity aggregation allows for the construction of tailored products for different user segments. The further use of these aggregates in DeFi optimizes yield throughout the LRT usage cycle.

It is important to note that liquidity aggregation in Mellow operates in a permissionless manner. There is no need to seek approval from LRT creators or obtain a whitelist from Mellow. This service can be developed both within Mellow’s infrastructure or even by external providers. Sounds good, but who needs it? We try to find out in the next section.

Verticalization

The described system verticalizes the creation and management of liquid derivatives. To understand who benefits from this, let's look at the different players that are part of the staking/restaking derivatives vertical:

Staking and Restaking Operators

Research Focused Risk Managers

Liquid Restaking/Staking Derivatives providers

DeFi: Money Markets with their own Risk Management

This stack offers a wide range of choices: node selection, restaking risk profile, risk management in DeFi protocols, etc.

For DeFi, Mellow Protocol solves yet another incompatibility issue. Imagine listing an LRT collateral on a lending platform today. Call it LRT 1. Some operator manages the hardware infrastructure and runs the nodes. Risk Curator A manages the risks of that LRT (maybe the team itself), selecting nodes and AVSs. The service provider of a lending protocol manages risks in the lending market by adjusting LTVs of that LRT collateral. Now what happens is:

Risk Curator A (the LRT team) changes parameters.

That should automatically trigger a reevaluation of parameters in the lending market.

But they can’t do so efficiently or at all. Whenever an operator changes something, it affects both LRT risk and lending market risks. This creates a communication issue between different risk levels. The concept of "code is law" doesn't work—any miscommunication between trusted players creates a significant risk for users.

Based on this, we believe in the necessity of vertical integration for service providers:

A risk curator on the lending market can create their own LRT and manage the risks at the "restaking level." That way, they own the vertical of collateral.

Institutional stakers can control the entire liquidity cycle of their clients, without the need to delegate management to a third-party LRT, while still providing composability to their users and expanding their product line towards DeFi.

This allows any existing player at any level of staking/restaking (infrastructure players like nodes and stakers, DeFi applications, LRT providers) to use Mellow’s infrastructure to create custom products with profiles and properties tailored to their users' needs. This approach can increase value accrual from their current user base and help attract new users.

Mellow enables the development of interconnected ecosystems by creating a collaborative space for Shared Security Networks, Risk Curators, Operators, Liquidity Providers, and DeFi protocols. We are committed to continually expanding and refining the components of the Restaking Ecosystem to simplify interactions, enhance transparency, and improve safety.

In this article, we described the concept of Mellow Vaults for the permissionless creation and curation of LRTs. However, the Mellow system is built for a broader set of use cases, not just pure restaking. But more on that in future articles. Stay tuned! Meanwhile check docs, code, and become part of the Mellow ecosystem!

Discord: https://discord.com/invite/mellow

Twitter: https://x.com/Mellowprotocol

Website: https://mellow.finance/