Introducing MultiVaults

Mellow is on a mission to let anyone access or create bespoke on-chain structured products.

Since launch, our modular infrastructure has allowed institutions and retail entrants alike to kickstart tailored strategies that deliver on-chain yield from varied sources across a wide scope of risk profiles.

Today, Mellow’s restaking vaults actively secure dozens of Symbiotic SSNs. But restaking is just one flavor in the expanding bazaar of on-chain yield.

Staking. Leveraged looping. Delta-neutral strategies.

The proliferation of new financial primitives and yield-generating assets has opened doors to complex cross-network strategies, regardless of risk appetite or level of sophistication.

At present, there is a number of yield sources with varying degrees of complexity, such as:

Liquid staking remains an entry-level strategy for many, with vaults like DVV not only sourcing validator rewards but also compounding points from multiple protocols.

Restaking strategies are available for Symbiotic SSNs and EigenLayer AVSs, granting additional rewards from protocols relying on shared security models.

Leveraged versions of both staking and restaking strategies require higher risk tolerance, using lending protocols like Aave, Morpho or Gearbox to loop collateral and increase net exposure.

Delta-neutral strategies are surging, thanks to stablecoins like USDe and USR, letting users hedge BTC, ETH, or SOL via perpetual and deliverable futures contracts.

Today, sophisticated multi-layered yield strategies can only be executed manually by juggling several disjointed protocols, reducing efficiency while compounding risk. Most attempts to aggregate and commingle on-chain yield have either been limited in scope or fully permissioned, restricting customization and plurality of choice.

Until now.

Enter MultiVault

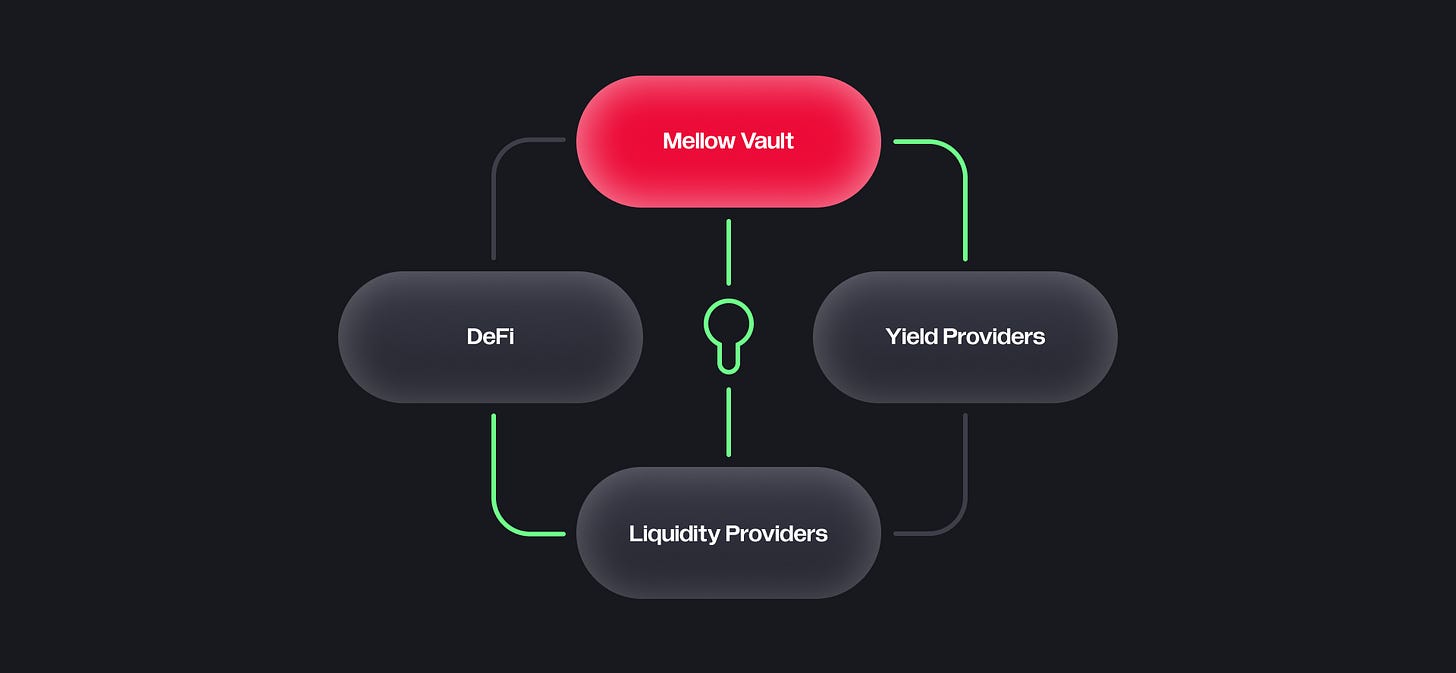

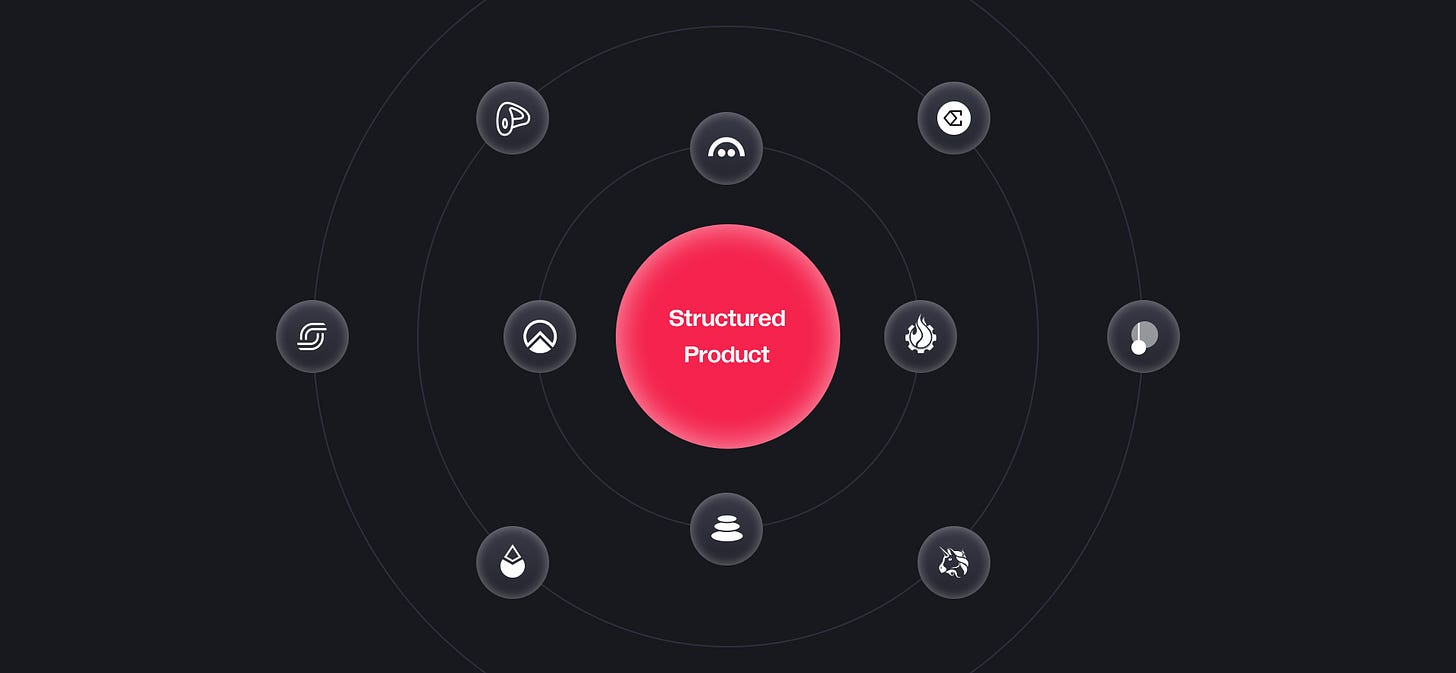

MultiVault is an all-in-one solution that provides unified and simultaneous access to on-chain yield from a wide range of financial instruments and decentralized protocols, enabling anyone to create or access complex, multi-source strategies within a single vault.

This allows users to consolidate the increasingly fragmented world of on-chain yield into a single, streamlined instrument tailored to their own risk profile and operational preferences.

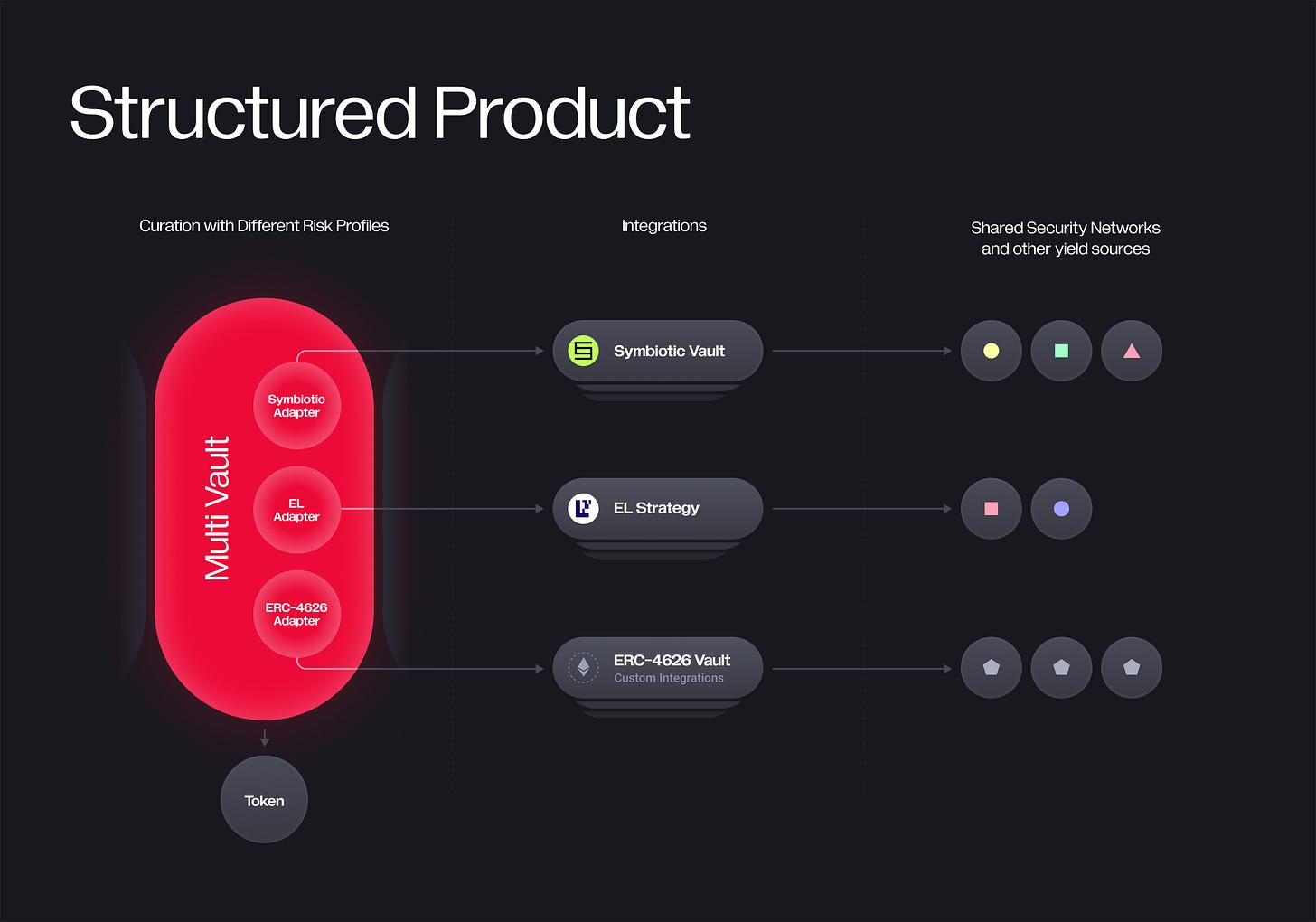

At its core, MultiVault is built on modular adapters that enable delegation to both Symbiotic SSNs and EigenLayer AVSs, while simultaneously allowing exposure to any yield-bearing vault that follows the ERC-4626 standard.

Why is this a big deal?

Institutions with the most stringent security and control requirements can now access existing or launch their own MultiVault for compliant on-chain yield from multiple sources. Whether it's a curated network set for restaking, tighter AML/KYC risk controls on lending, or privacy safeguards, these requirements can all be integrated into a single MultiVault to meet regulatory provisions.

Retail users looking for a broader variety of yield sources and reward opportunities can now access MultiVaults with built-in support for Symbiotic, EigenLayer, and any ERC-4626 vault. This unlocks a wider range of both conservative and high-risk strategies.

Vault curators can leverage MultiVaults to expand exposure, optimize allocation, and maximize rewards across supported networks. This includes the creation of complex multi-leg strategies with different fee tiers, staking and DeFi protocols, operator sets, and more.

Institution-Grade

Recently introduced regulatory climate and the maturation of crypto-native primitives have narrowed the TradFi gap, opening new opportunities for Web2 incumbents looking to allocate capital.

The main hurdles for institutional adoption are no longer legislative—they’re operational.

To enable compliant access to on-chain yield, institutions now require:

Custom onboarding venues tailored to their security and risk provisions

Streamlined intelligence on both existing and emerging on-chain yield opportunities

MultiVault directly addresses both.

For onboarding, institutions can use MultiVault’s flexible design to build bespoke strategies that align with their risk profile, operational needs, and security mandates—all while maintaining full custody of assets.

Those preferring to outsource strategy design and execution can tap into curated MultiVaults managed by professional asset managers and risk analysts serving highly regulated clients.

On intelligence, MultiVault acts as a discovery engine for custom structured products, offering a real-time view of the evolving yield landscape, trending strategies, and new financial primitives—helping sophisticated users reduce information asymmetry and potential blind spots.

MultiVault has undergone multiple audits to ensure the highest level of security and is currently live on Mellow.

For additional security enhancement, Mellow is leveraging Hypernative solutions to secure its Multivaults. Hypernative continuously monitors transactions and is configured with the authority to halt withdrawals if any suspicious activity is detected, ensuring that potential threats are addressed immediately.

Moreover, during critical operations, Hypernative sends notifications directly to the Mellow team. This prompt alert system enables key decision-makers to review and respond to any changes in multisig settings, further strengthening the security of Mellow's assets.

Core Principles

MultiVault builds on our vision for on-chain structured products that anyone can access or create based on their personal risk appetite and yield profile. It relies on two core principles underpinning the Mellow ecosystem: simplicity and aggregation.

So what makes MultiVault a Schelling point for yield seekers, DeFi strategists, and vault creators?

Unified Framework

MultiVault brings together different assets, protocols, and curators under one umbrella. It’s a modular seedbed for multi-pronged strategies that combine yield aggregation with permissionless execution.

Streamlined Vaults

Subvaults will do all the heavy lifting for end users, automating delegation to SSNs, AVSs, and any ERC-4626 vaults. On the supply side, MultiVault further reduces the barrier to entry for enterprises that lack the expertise or resources to build their own structured products from scratch.

Aggregation Machine

By pooling liquidity and routing it intelligently, MultiVault enables smart aggregation of yield opportunities across the restaking realm and beyond. Mellow users are treated to a DeFi smorgasbord, accessing unique strategies while optimizing rewards.

Fully Cypherpunk

Permissionless deployment and delegation are innate to MultiVault. Users are free to interact with vaults without curator approval and always keep custody of their assets. The credibly neutral design removes development and operational bottlenecks while future-proofing the protocol.

Technical Overview

Built on top of the ERC-4626 standard, MultiVault makes a few key improvements to restaking and other yield-generating strategies (such as limits, whitelists, and deposit/withdrawal locks) making it ideal for institutional-grade asset management.

Key Highlights:

MultiVault operates with a single ERC-20 base asset, so users can simplify their portfolio while gaining exposure to new yield opportunities without exposing to swap fees and price risk from other assets

Assets are dynamically allocated across subvaults, leveraging supported protocols while diversifying risk

By using sophisticated adapters and protocol-specific withdrawal queues, MultiVault balances yield generation and users’ liquidity needs

Subvaults

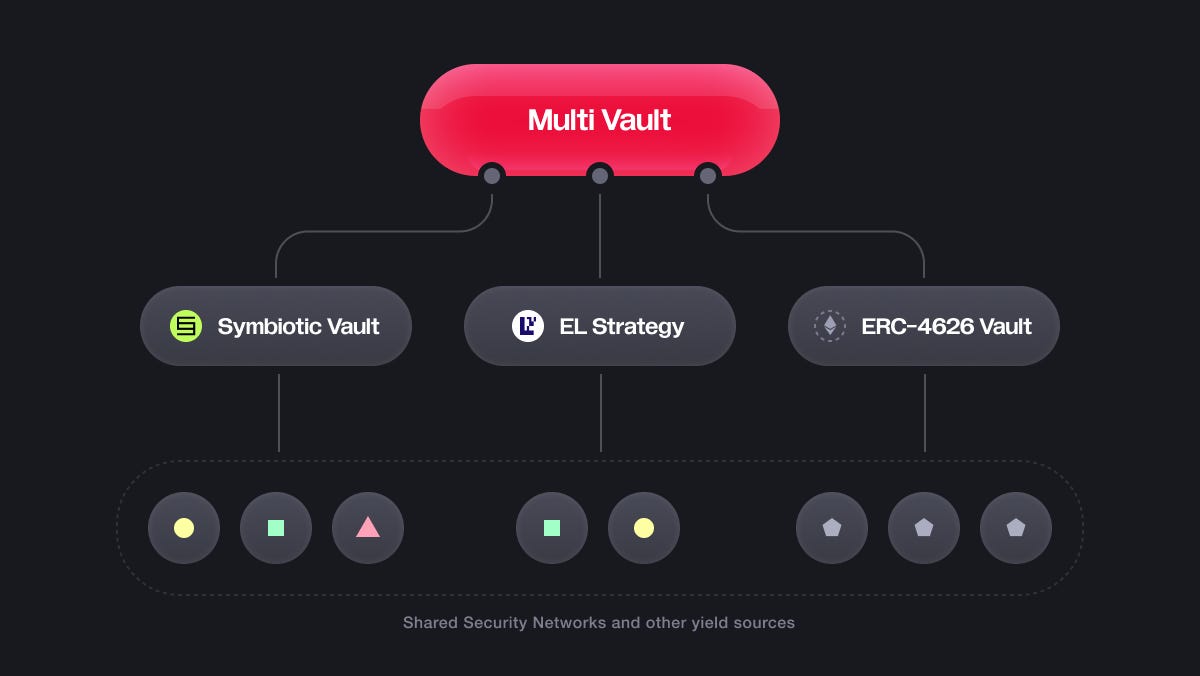

MultiVault integrates with three adapters enabling working simultaneously with multiple subvaults:

SYMBIOTIC subvaults – for restaking within Symbiotic vaults

EIGENLAYER subvaults – for interacting with EigenLayer

ERC-4626 subvaults – for generic compatibility with ERC-4626-compliant yield tokens

Different networks on Symbiotic and EigenLayer might have unique vault requirements, making it impossible to consolidate them into a single structure. To solve this, each MultiVault can host multiple subvaults of each type.

This not only ensures compatibility but also unlocks additional risk management opportunities—allowing users to create diverse risk-reward subvault profiles and seamlessly rebalance between them.

Withdrawal Queues

Within restaking, MultiVault introduces protocol-specific withdrawal queues, which handle complex exit processes while maintaining liquidity for restakers.

Previously, an LRT holder had to wait several days for their withdrawal to be processed by the curator. Now, immediate liquidity is withdrawn from a buffer (base asset, commonly wstETH), while any additional claims are fulfilled by exiting from subvaults.

In particular:

SymbioticWithdrawalQueue manages epoch-based withdrawals from Symbiotic farms.

EigenLayerWithdrawalQueue ensures smooth withdrawals within EigenLayer, adhering to withdrawal delays and limiting pending requests to avoid congestion.

Protocol-specific withdrawal queues prioritize liquidity and minimize downtime for restakers, giving them ready access to funds while maintaining strategic allocation.

Ratio-Based Asset Management

The RatiosStrategy governs the allocation of user assets between subvaults during deposits, withdrawals, and rebalancing. It enforces minimum and maximum thresholds for asset distribution to balance capital safety with yield maximization. In practice, this ensures capital remains actively deployed while avoiding overexposure to any single yield source.

Deposits

When a user deposits assets into the MultiVault, they are allocated across subvaults in a two-stage process:

Subvaults are filled to ensure that staked assets ≥ minimum asset threshold.

Excess tokens are distributed across subvaults until staked assets ≤ maximum asset threshold.

As a result, every deposit contributes to yield generation while maintaining a liquidity buffer for potential withdrawals.

Withdrawals

Withdrawals follow a liquidity-first process that simplifies UX while maintaining strategic allocation:

Assets exceeding the max asset threshold are withdrawn first.

The withdrawal algorithm ensures that staked assets ≥ the minimum asset threshold in all subvaults.

Pending and claimable assets are retrieved next, with priority given to liquid assets for faster payouts.

Exceptional withdrawals (where staked assets > 0) are processed only to prevent violations of the strategy.

This tiered approach balances access to liquidity with yield protection, ensuring withdrawals are both prompt and non-disruptive to MultiVault’s long-term strategy.

Curators can set a buffer for instant withdrawals, meaning a designated amount of stake remains undelegated and available for immediate withdrawal upon request.

Rebalancing

The rebalancing algorithm helps align the distribution of user funds with the allocation ratios defined by MultiVault’s strategy. The process is designed to:

Withdraw excess assets from over-allocated subvaults (where staked assets > max asset threshold).

Redistribute liquid assets to meet the minimum ratios of underfunded subvaults.

Optimize remaining assets so that staked assets ≤ max asset threshold in all subvaults.

This rebalancing logic drives capital efficiency and protects user returns by keeping assets in optimal conditions to generate yield.

Want to launch a MultiVault? Let’s talk!

The MultiVault is an all-in-one gateway to on-chain yield, opening doors to bespoke, modular strategies and the creation of net-new structured products.

Through dynamic integration with both Symbiotic and EigenLayer, a robust subvault architecture and protocol-specific withdrawal queues, MultiVault offers institutional actors and retail users a bleeding-edge framework for capital efficiency and strategic asset allocation.

If you’re interested in launching your own MultiVault, DM us on Twitter or ping one of our mods in Mellow’s Discord, and we’ll get in touch!

Lfg