Mellow Protocol: Achievements and Future Plans

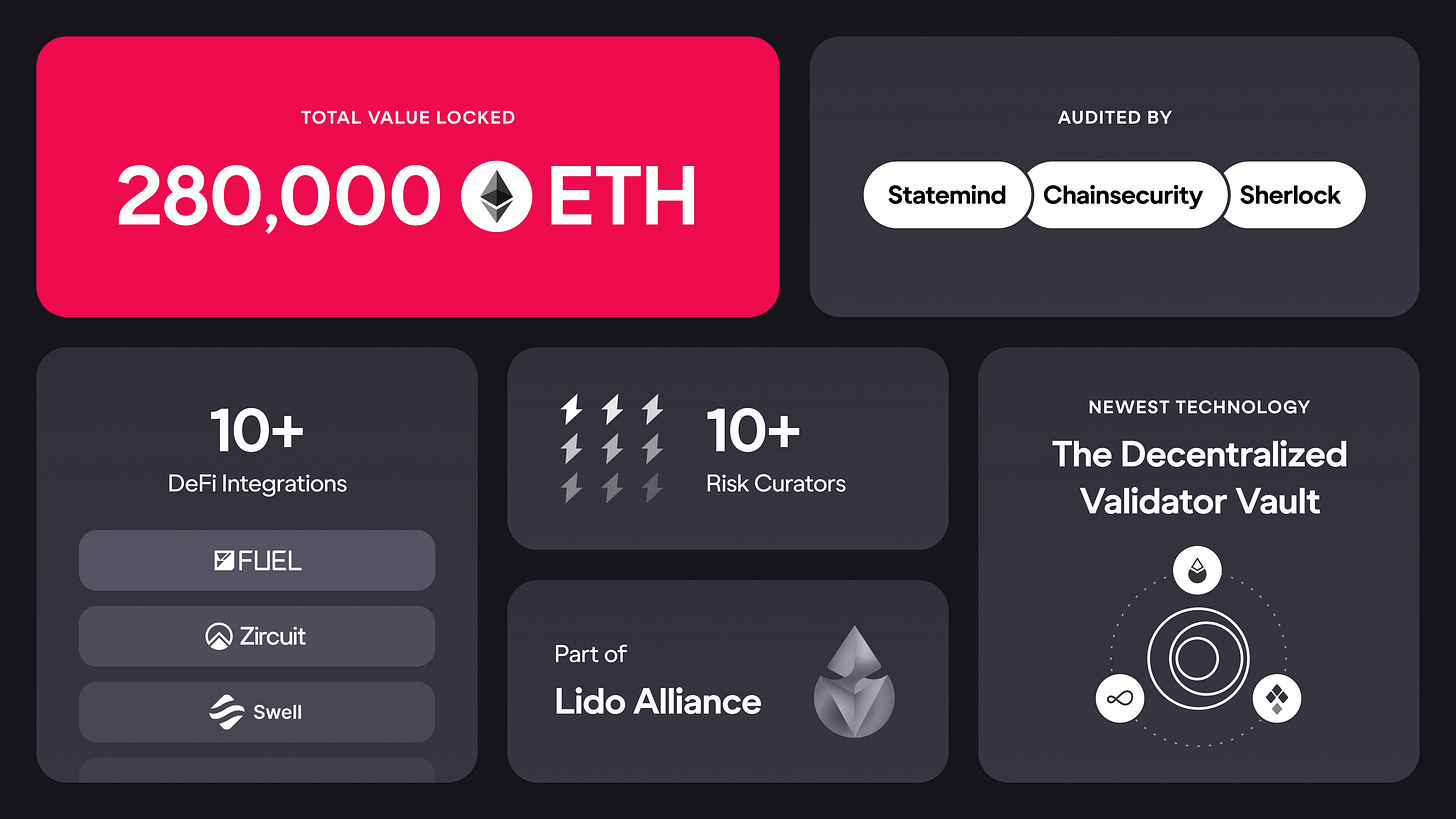

Mellow Protocol reached a TVL of 280,000 ETH in 3 months after launch. Organically, without relying on whale liquidity deals and special terms. These numbers are only possible thanks to curators, partners, and the Mellow community – your experience and feedback made Mellow Protocol more user-friendly and accessible for all.

However, Mellow is just getting started: more partnerships and integrations are on the way to make it the most trusted modular infrastructure for AVSes and enable the growth of the Mellow ecosystem.

Let’s look into the highlights of this 3-month journey and discuss future plans:

Lastest Integrations

Upcoming Launches

Curators

Security and Audits

Latest Articles

More data on Mellow growth is available in Defillama and community dashboards. Let’s get started!

Retrospective and New Faces: Latest Integrations

Part of the Mellow Protocol's strategy for improving its functionality are integrations with DeFi primitives and infrastructures. They enhance user experience and enable seamless interactions with other financial tools and services within the ecosystem. In 2 months, Mellow has had more than 10 DeFi integrations. But it’s just the beginning: among the newest partners, the protocol is ready to greet Fuel, Zircuit, and Swell.

Fuel is a roll-up OS for Ethereum. By depositing to Fuel pools, users earn points, unlock rewards, and contribute to the Fuel Network before their Mainnet Launch. Zircuit is a fully EVM-compatible zk rollup with AI-enabled sequencer-level security. By depositing to Zircuit pools, users participate in the Zircuit staking program. It’s designed to reward participants and communities and bootstrap liquidity to the protocol. Swell L2 is a zk rollup. With this integration, users earn both blockchain rewards and restaked AVS rewards. In return, they are provided with a yield-bearing liquid token, LST or LRT, to hold or participate in the wider DeFi ecosystem to gain additional yield.

By utilizing Mellow LRTs to secure Fuel, Zircuit, or Swell, users can boost points from Mellow Protocol on top of what they’re making now. Integrations are not the only part of the ecosystem’s growth, the other part is partnerships.

Expanding the Ecosystem: Newest and Upcoming Launches

Let’s talk about the newest launches. Among the closest: Obol and SSV vaults went live last week! These new additions incentivize deposits into a Simple DVT together with Lido Finance. With this collaboration, Mellow Protocol provides the Mellow DVstETH vault – an infrastructure backbone that turns native liquid staking into reality. This technology will attract new validators and extend the popularity of DVT, further supporting the Ethereum ecosystem. You can read more about the Mellow DVstETH vault and the technology behind it in the upcoming article.

In the following weeks, Mellow will be launching the full-scale product together with Symbiotic, updating the system to support delegation. More upcoming partnerships include bridges on some popular L2s a’njnd more. Follow X/Twitter for updates on these.

The essential part of the Mellow Protocol ecosystem is the work of curators. Rather than simply managing user funds, curators are business entities responsible for building and expanding their ecosystems. These entities oversee the development of investment strategies, ensure compliance with established policies, and optimize the allocation of user assets to generate returns for liquidity providers within their networks. It’s only logical to give more attention to Mellow curators…

Curator Spotlight:

Meet Mellow curators: in the past months, Mellow Protocol partnered with more than 10 entities joining us as risk curators. They handle withdrawals for users, which are processed within 1-7 days. By and large, this is the curator’s primary role that all users encounter every day but of course, curators do much more than that: they manage the funds of the vaults and expand their ecosystems within Mellow.

Curator Profiles:

P2P: P2P is a non-custodial staking and restaking provider with $8B and over 100k delegators across more than 50 unique blockchain networks. It is also one of the Top 3 NCS providers at the moment.

Vault: Restaking Vault ETH

TVL: $196M

Mev Capital: MEV Capital, an on-chain digital asset manager, is one of the largest TVL boosters of restaking protocols worldwide. They have experience in managing over $300M of LP capital.

Vaults: Amphor Restaked ETH, Ethena LRT Vault (sUSDe, ENA)

TVL: $166M (Amphor), $41M (sUSDe), $21M (ENA)

Renzo: Renzo is one of the biggest restaking protocols with over $3B in liquid restaking TVL. By using Mellow’s modular stack, they can create risk-adjusted LRTs faster and easier.

Vault: Renzo Restaked LST

TVL: $125M

Mev Capital / Re7 Labs / K3 Capital: MEV Capital brings the asset management expertise, Re7 Labs focuses on the DeFi R&D and risk analysis, and K3 Capital are the strategic investment and advisory with $250M in managed assets. Together, they join forces in assessing upcoming AVS applications interested in having $sUSDe and $ENA securing their economic consensus and helping them find the right parameters.

Vaults: Ethena LRT Vault (sUSDe, ENA)

TVL: $41M (sUSDe), $21M (ENA)

Steakhouse Financial: Steakhouse is a crypto-native advisory firm, working with companies like Maker DAO, Lido Finance, Morpho, and Angle Protocol. Steakhouse is also the largest curator of Morpho.

Vault: Steakhouse Restaking Vault

TVL: $38M

Re7 Labs: Re7 Labs is a research and investment firm advancing blockchain technology. Their work includes creating new consensus mechanisms, improving network security, and developing decentralized applications. You can learn about their restaking and risk management framework from the blog.

Vault: Re7 Labs LRT

TVL: $34M

InfStones: InfStones Global is a web3 infrastructure platform supporting over 80 blockchain protocols. They are trusted by OKX, Binance, Lido, Chainlink, and many others.

Vault: InfStones Restaked ETH

TVL: $1M

Chorus One: Chorus One is one of the biggest institutional stake providers with roughly $2.4B in TVL across more than 50 networks.

Vault: ETH Restaking Pro

TVL: $875K

Luganodes: Luganodes is a Swiss-operated protocol, with more than 9k validators on Ethereum Mainnet. They are the second largest node operator for native restaking and support all major chains. Currently, they have around $3B in staked assets across more than 45 networks.

Vault: Luganodes Restaked ETH

TVL: $27K

While the Luganodes and InfStones vaults are beginning with a measured pace, Mellow Protocol fully recognizes their deep expertise and considerable potential. To read more about the vaults, see Mellow website.

Security: ChainSecurity Audit and Enhanced Monitoring

Mellow Protocol is serious about smart contract security, so it completed audits by ChainSecurity and Statemind, both audits are available here. Mellow also completed the Sherlock community contest and expects the audit from OpenZeppelin, a leading company that worked with Uniswap, AAVE, and Compound. Additionally, Mellow enhanced the monitoring capabilities with Hypernative, implemented circuit breakers, and is gearing up for the launch of Immunefi in several weeks.

Transparency: Aggregation and Isolation of Risks in Restaking Markets

Mellow Protocol published a paper on ‘Aggregation and Isolation of Risks in Restaking Markets’ on its Substack. It is a vision approach to reducing risks and enabling a healthy ecosystem by creating a collaborative space for Shared Security Networks, Risk Curators, Operators, Liquidity Providers, and DeFi protocols. Mellow is committed to continually expanding and refining the components of the Restaking Ecosystem to simplify interactions, enhance transparency, and improve safety.

Mellow as a modular infrastructure for permissionless LRT creation and curation responding to the needs of AVSes, risk curators, operators, and users. As an AVS, you can use a flexible infrastructure provided by Mellow. It will allow you to create and manage vaults, LRTs, and risk profiles and choose the go-to strategy suitable for your needs. As a protocol, Mellow is on the mission of commoditizing access to consensus mechanisms for a broader range of users. How? Mellow suggests a user-friendly infrastructure that allows users to interact with operators and choose risk-management strategies. This means that user portfolios can be not only diversified but tailored to their preferences: as a result, they’ll get a vertically integrated portfolio tailored to their needs.

As Mellow continues to grow, stay tuned for updates on the upcoming launches, integrations, audits, and milestones. Follow Mellow on X/Twitter to be the first to know about Mellow’s progress. Become a part of the Mellow ecosystem!

Discord: https://discord.com/invite/mellow/

X/Twitter: https://x.com/Mellowprotocol/

Website: https://mellow.finance/

Docs: https://docs.mellow.finance/

GitHub: https://github.com/mellow-finance/

dApp: https://app.mellow.finance/